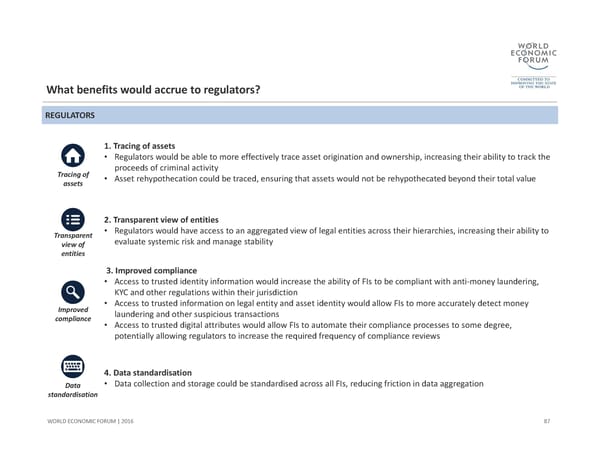

87 WORLD ECONOMIC FORUM | 2016 REGULATORSWhat benefits would accrue to regulators? Transparent view of entities 2. Transparent view of entities •Regulators would have access to an aggregated view of legal entities across their hierarchies, increasing their ability to evaluate systemic risk and manage stability Improved compliance 3. Improved compliance •Access to trusted identity information would increase the ability of FIs to be compliant with anti‐money laundering, KYC and other regulations within their jurisdiction •Access to trusted information on legal entity and asset identity would allow FIs to more accurately detect money laundering and other suspicious transactions•Access to trusted digital attributes would allow FIs to automate their compliance processes to some degree, potentially allowing regulators to increase the required frequency of compliance reviews Data standardisation 4. Data standardisation •Data collection and storage could be standardised across all FIs, reducing friction in data aggregation 1. Tra c ing of assets •Regulators would be able to more effectively trace asset origination and ownership, increasing their ability to track the proceeds of criminal activity •Asset rehypothecation could be traced, ensuring that assets would not be rehypothecated beyond their total value Tracing of assets

A Blueprint for Digital Identity Page 87 Page 89

A Blueprint for Digital Identity Page 87 Page 89