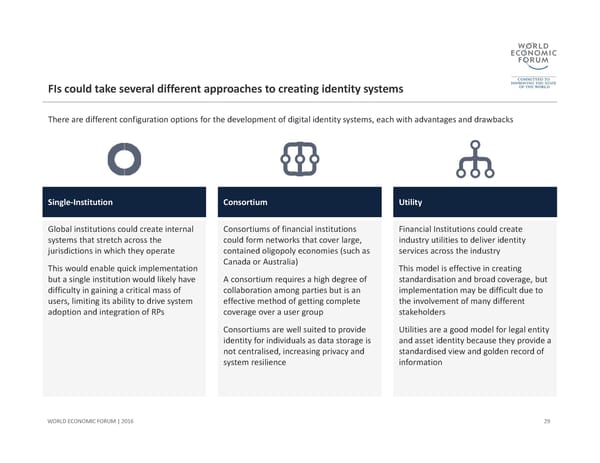

FIs could take several different approaches to creating identity systemsGlobal institutions could create internal systems that stretch across the jurisdictions in which they operate This would enable quick implementation but a single institution would likely have difficulty in gaining a critical mass of users, limiting its ability to drive system adoption and integration of RPs 29 Consortiums of financial institutions could form networks that cover large, contained oligopoly economies (such as Canada or Australia) A consortium requires a high degree of collaboration among parties but is an effective method of getting complete coverage over a user group Consortiums are well suited to provide identity for individuals as data storage is not centralised, increasing privacy and system resilience Financial Institutions could create industry utilities to deliver identity services across the industry This model is effective in creating standardisation and broad coverage, but implementation may be difficult due to the involvement of many different stakeholders Utilities are a good model for legal entity and asset identity because they provide a standardised view and golden record of information WORLD ECONOMIC FORUM | 2016There are different configuration options for the development of digital identity systems, each with advantages and drawbacksSingle‐Institution Consortium Utility

A Blueprint for Digital Identity Page 29 Page 31

A Blueprint for Digital Identity Page 29 Page 31