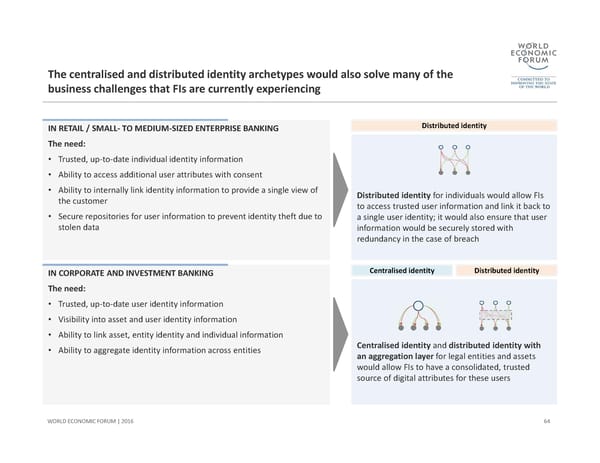

The centralised and distributed identity archetypes would also solve many of the business challenges that FIs are currently experiencing 64 WORLD ECONOMIC FORUM | 2016 IN RETAIL / SMALL‐TO MEDIUM‐SIZED ENTERPRISE BANKING The need: •Trusted, up‐to‐date individual identity information •Ability to access additional user attributes with consent •Ability to internally link identity information to provide a single view of the customer •Secure repositories for user information to prevent identity theft due to stolen data IN CORPORATE AND INVESTMENT BANKING The need: •Trusted, up‐to‐date user identity information •Visibility into asset and user identity information •Ability to link asset, entity identity and individual information •Ability to aggregate identity information across entities Distributed identity Distributed identityfor individuals would allow FIs to access trusted user information and link it back to a single user identity; it would also ensure that user information would be securely stored with redundancy in the case of breach Centralised identity Centralised identity and distributed identity with an aggregation layer for legal entities and assets would allow FIs to have a consolidated, trusted source of digital attributes for these users Distributed identity

A Blueprint for Digital Identity Page 64 Page 66

A Blueprint for Digital Identity Page 64 Page 66