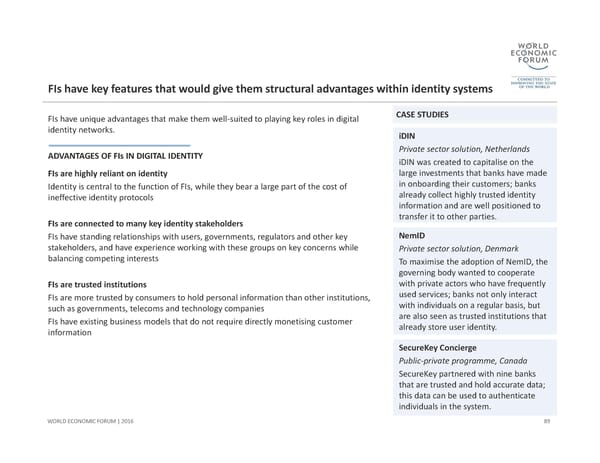

FIs have key features that would give them structural advantages within identity systemsFIs have unique advantages that make them well‐suited to playing key roles in digital identity networks. ADVANTAGES OF FIs IN DIGITAL IDENTITY FIs are highly reliant on identity Identity is central to the function of FIs, while they bear a large part of the cost of ineffective identity protocols FIs are connected to many key identity stakeholders FIs have standing relationships with users, governments, regulators and other key stakeholders, and have experience working with these groups on key concerns while balancing competing interests FIs are trusted institutions FIs are more trusted by consumers to hold personal information than other institutions, such as governments, telecoms and technology companies FIs have existing business models that do not require directly monetising customer information 89 WORLD ECONOMIC FORUM | 2016 CASE STUDIES iDIN Private sector solution, Netherlands iDIN was created to capitalise on the large investments that banks have made in onboarding their customers; banks already collect highly trusted identity information and are well positioned to transfer it to other parties. NemID Private sector solution, Denmark To maximise the adoption of NemID, the governing body wanted to cooperate with private actors who have frequently used services; banks not only interact with individuals on a regular basis, but are also seen as trusted institutions that already store user identity. SecureKey Concierge Public‐private programme, Canada SecureKey partnered with nine banks that are trusted and hold accurate data; this data can be used to authenticate individuals in the system.

A Blueprint for Digital Identity Page 89 Page 91

A Blueprint for Digital Identity Page 89 Page 91