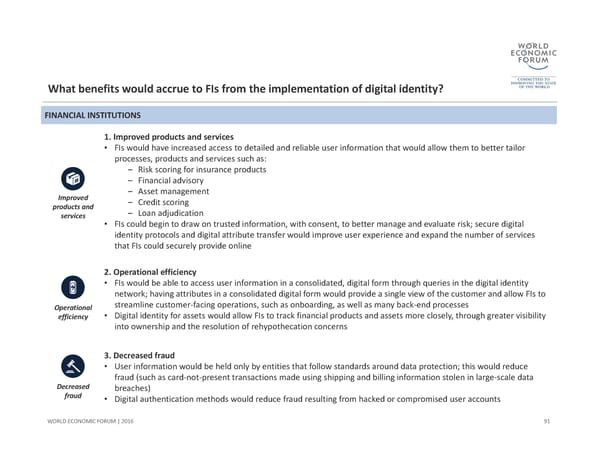

91 WORLD ECONOMIC FORUM | 2016 FINANCIAL INSTITUTIONSWhat benefits would accrue to FIs from the implementation of digital identity? Operational efficiency 2. Operational efficiency •FIs would be able to access user information in a consolidated, digital form through queries in the digital identity network; having attributes in a consolidated digital form would provide a single view of the customer and allow FIs to streamline customer‐facing operations, such as onboarding, as well as many back‐end processes •Digital identity for assets would allow FIs to track financial products and assets more closely, through greater visibility into ownership and the resolution of rehypothecation concerns Decreased fraud 3. Decreased fraud •User information would be held only by entities that follow standards around data protection; this would reduce fraud (such as card‐not‐present transactions made using shipping and billing information stolen in large‐scale data breaches) •Digital authentication methods would reduce fraud resulting from hacked or compromised user accounts 1. Improved products and services •FIs would have increased access to detailed and reliable user information that would allow them to better tailor processes, products and services such as: –Risk scoring for insurance products – Financial advisory – Asset management –Credit scoring –Loan adjudication •FIs could begin to draw on trusted information, with consent, to better manage and evaluate risk; secure digital identity protocols and digital attribute transfer would improve user experience and expand the number of services that FIs could securely provide online Improved products and services

A Blueprint for Digital Identity Page 91 Page 93

A Blueprint for Digital Identity Page 91 Page 93