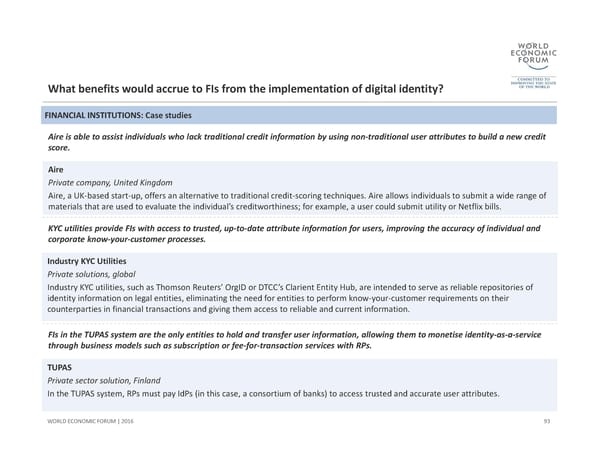

93 WORLD ECONOMIC FORUM | 2016 FINANCIAL INSTITUTIONS: Case studies What benefits would accrue to FIs from the implementation of digital identity? Aire Private company, United Kingdom Aire, a UK‐based start‐up, offers an alternative to traditional credit‐scoring techniques. Aire allows individuals to submit a wide range of materials that are used to evaluate the individual’s creditworthiness; for example, a user could submit utility or Netflix bills. Industry KYC Utilities Private solutions, global Industry KYC utilities, such as Thomson Reuters’ OrgID or DTCC ’s Clarient Entity Hub, are intended to serve as reliable repositories of identity information on legal entities, eliminating the need for entities to perform know‐your‐customer requirements on their counterparties in financial transactions and giving them access to reliable and current information. Aire is able to assist individuals who lack traditional credit information by using non‐traditional user attributes to build a new credit score. KYC utilities provide FIs with access to trusted, up‐to‐date attribute information for users, improving the accuracy of individual and corporate know‐your‐customer processes. TUPAS Private sector solution, Finland In the TUPAS system, RPs must pay IdPs (in this case, a consortium of banks) to access trusted and accurate user attributes. FIs in the TUPAS system are the only entities to hold and transfer user information, allowing them to monetise identity‐as‐a‐service through business models such as subscription or fee‐for‐transaction services with RPs.

A Blueprint for Digital Identity Page 93 Page 95

A Blueprint for Digital Identity Page 93 Page 95