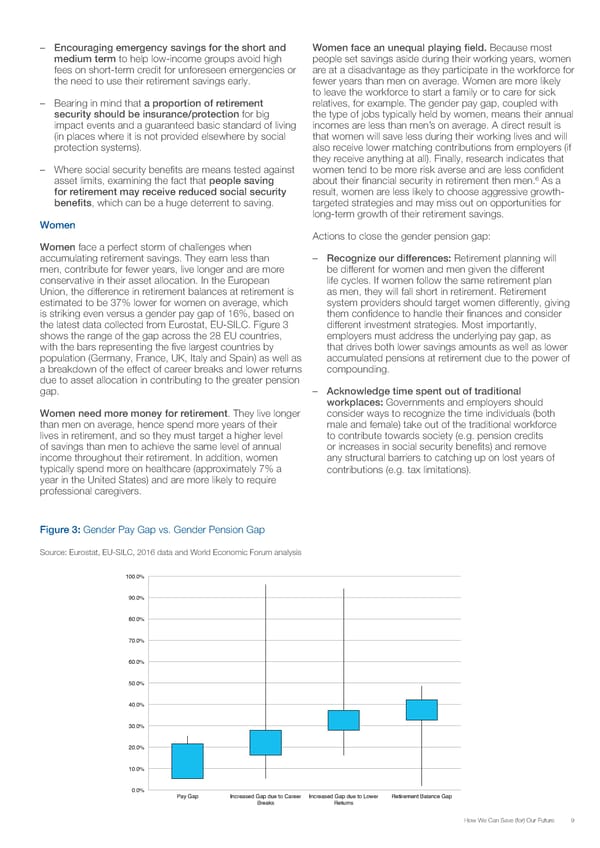

– Encouraging emergency savings for the short and Women face an unequal playing field. Because most medium term to help low-income groups avoid high people set savings aside during their working years, women fees on short-term credit for unforeseen emergencies or are at a disadvantage as they participate in the workforce for the need to use their retirement savings early. fewer years than men on average. Women are more likely to leave the workforce to start a family or to care for sick – Bearing in mind that a proportion of retirement relatives, for example. The gender pay gap, coupled with security should be insurance/protection for big the type of jobs typically held by women, means their annual impact events and a guaranteed basic standard of living incomes are less than men’s on average. A direct result is (in places where it is not provided elsewhere by social that women will save less during their working lives and will protection systems). also receive lower matching contributions from employers (if they receive anything at all). Finally, research indicates that – Where social security benefits are means tested against women tend to be more risk averse and are less confident asset limits, examining the fact that people saving about their financial security in retirement then men.6 As a for retirement may receive reduced social security result, women are less likely to choose aggressive growth- benefits, which can be a huge deterrent to saving. targeted strategies and may miss out on opportunities for long-term growth of their retirement savings. Women Actions to close the gender pension gap: Women face a perfect storm of challenges when accumulating retirement savings. They earn less than – Recognize our differences: Retirement planning will men, contribute for fewer years, live longer and are more be different for women and men given the different conservative in their asset allocation. In the European life cycles. If women follow the same retirement plan Union, the difference in retirement balances at retirement is as men, they will fall short in retirement. Retirement estimated to be 37% lower for women on average, which system providers should target women differently, giving is striking even versus a gender pay gap of 16%, based on them confidence to handle their finances and consider the latest data collected from Eurostat, EU-SILC. Figure 3 different investment strategies. Most importantly, shows the range of the gap across the 28 EU countries, employers must address the underlying pay gap, as with the bars representing the five largest countries by that drives both lower savings amounts as well as lower population (Germany, France, UK, Italy and Spain) as well as accumulated pensions at retirement due to the power of a breakdown of the effect of career breaks and lower returns compounding. due to asset allocation in contributing to the greater pension gap. – Acknowledge time spent out of traditional workplaces: Governments and employers should Women need more money for retirement. They live longer consider ways to recognize the time individuals (both than men on average, hence spend more years of their male and female) take out of the traditional workforce lives in retirement, and so they must target a higher level to contribute towards society (e.g. pension credits of savings than men to achieve the same level of annual or increases in social security benefits) and remove income throughout their retirement. In addition, women any structural barriers to catching up on lost years of typically spend more on healthcare (approximately 7% a contributions (e.g. tax limitations). year in the United States) and are more likely to require professional caregivers. Figure 3: Gender Pay Gap vs. Gender Pension Gap Source: Eurostat, EU-SILC, 2016 data and World Economic Forum analysis 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Pay GapIncreased Gap due to Career Increased Gap due to Lower Retirement Balance Gap Breaks Returns How We Can Save (for) Our Future 9

How can we save for our future Page 8 Page 10

How can we save for our future Page 8 Page 10