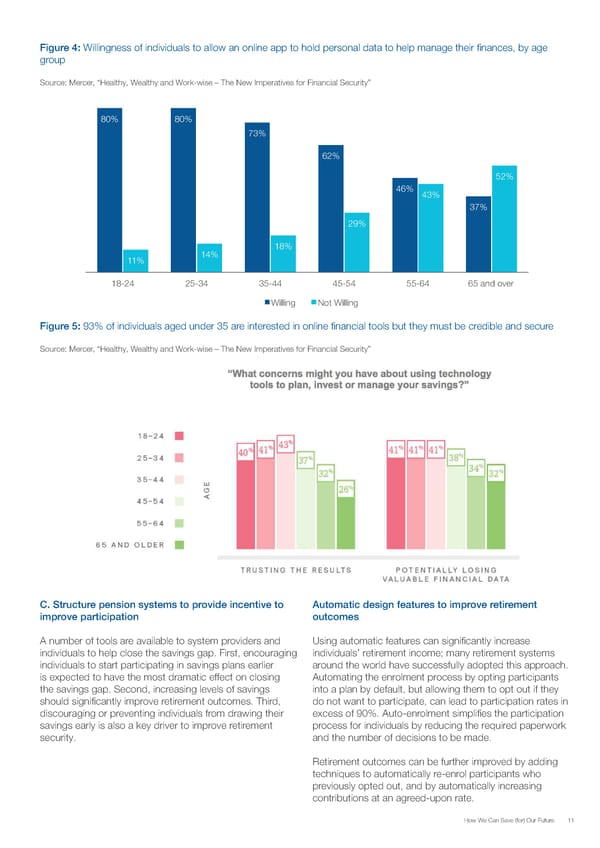

Figure 4: Willingness of individuals to allow an online app to hold personal data to help manage their finances, by age group Source: Mercer, “Healthy, Wealthy and Work-wise – The New Imperatives for Financial Security” 80% 80% 73% 62% 52% 46% 43% 37% 29% 18% 11% 14% 18-24 25-34 35-44 45-54 55-64 65 and over Willing Not Willing Figure 5: 93% of individuals aged under 35 are interested in online financial tools but they must be credible and secure Source: Mercer, “Healthy, Wealthy and Work-wise – The New Imperatives for Financial Security” C. Structure pension systems to provide incentive to Automatic design features to improve retirement improve participation outcomes A number of tools are available to system providers and Using automatic features can significantly increase individuals to help close the savings gap. First, encouraging individuals’ retirement income; many retirement systems individuals to start participating in savings plans earlier around the world have successfully adopted this approach. is expected to have the most dramatic effect on closing Automating the enrolment process by opting participants the savings gap. Second, increasing levels of savings into a plan by default, but allowing them to opt out if they should significantly improve retirement outcomes. Third, do not want to participate, can lead to participation rates in discouraging or preventing individuals from drawing their excess of 90%. Auto-enrolment simplifies the participation savings early is also a key driver to improve retirement process for individuals by reducing the required paperwork security. and the number of decisions to be made. Retirement outcomes can be further improved by adding techniques to automatically re-enrol participants who previously opted out, and by automatically increasing contributions at an agreed-upon rate. How We Can Save (for) Our Future 11

How can we save for our future Page 10 Page 12

How can we save for our future Page 10 Page 12