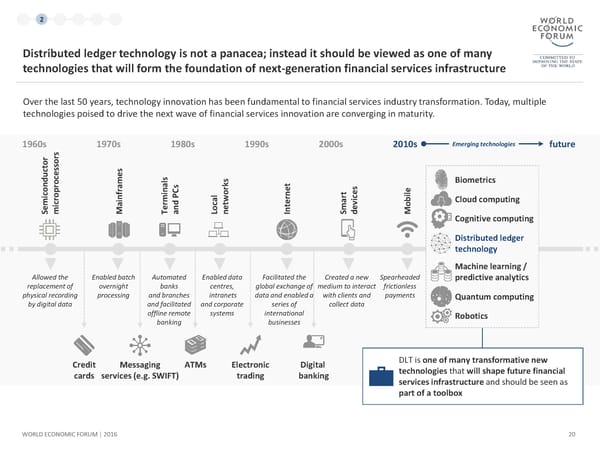

1 2 3 4 5 6 Distributed ledger technology is not a panacea; instead it should be viewed as one of many technologies that will form the foundation of next-generation financial services infrastructure Over the last 50 years, technology innovation has been fundamental to financial services industry transformation. Today, multiple technologies poised to drive the next wave of financial services innovation are converging in maturity. 1960s s 1970s 1980s 1990s 2000s 2010s Emerging technologies future rto sor cdu ces ls no pro na s rks t s e Biometrics cmi cro ainframes rmid PC cal two vice obil Cloud computing eS mi M Te an Lo ne Interne Smartde M Cognitive computing Distributed ledger technology Machine learning / Allowed the Enabled batch Automated Enabled data Facilitated the Created a new Spearheaded predictive analytics replacement of overnight banks centres, global exchange of medium to interact frictionless physical recording processing and branches intranets data and enabled a with clients and payments Quantum computing by digital data and facilitated and corporate series of collect data offline remote systems international Robotics banking businesses Credit Messaging ATMs Electronic Digital DLT is one of many transformative new cards services (e.g. SWIFT) trading banking technologiesthat will shape future financial services infrastructure and should be seen as part of a toolbox WORLD ECONOMIC FORUM | 2016 20

The Future of Financial Infrastructure Page 19 Page 21

The Future of Financial Infrastructure Page 19 Page 21