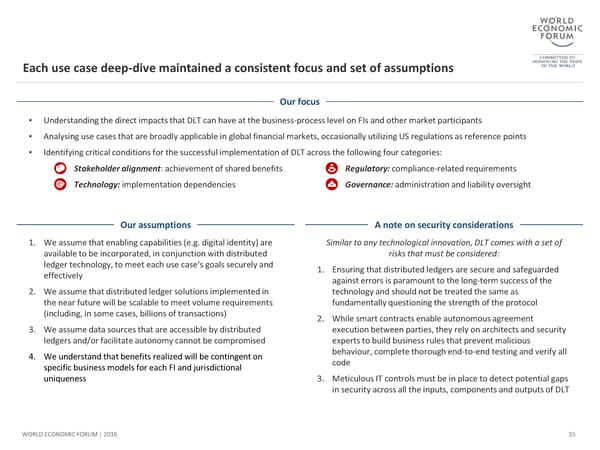

Each use case deep-dive maintained a consistent focus and set of assumptions Our focus • Understanding the direct impacts that DLT can have at the business-process level on FIs and other market participants • Analysing use cases that are broadly applicable in global financial markets, occasionally utilizing US regulations as reference points • Identifying critical conditions for the successful implementation of DLT across the following four categories: Stakeholder alignment: achievement of shared benefits Regulatory: compliance-related requirements Technology: implementation dependencies Governance: administration and liability oversight Our assumptions A note on security considerations 1. We assume that enabling capabilities (e.g. digital identity) are Similar to any technological innovation, DLT comes with a set of available to be incorporated, in conjunction with distributed risks that must be considered: ledger technology, to meet each use case’s goals securely and 1. Ensuring that distributed ledgers are secure and safeguarded effectively against errors is paramount to the long-term success of the 2. We assume that distributed ledger solutions implemented in technology and should not be treated the same as the near future will be scalable to meet volume requirements fundamentally questioning the strength of the protocol (including, in some cases, billions of transactions) 2. While smart contracts enable autonomous agreement 3. We assume data sources that are accessible by distributed execution between parties, they rely on architects and security ledgers and/or facilitate autonomy cannot be compromised experts to build business rules that prevent malicious 4. We understand that benefits realized will be contingent on behaviour, complete thorough end-to-end testing and verify all specific business models for each FI and jurisdictional code uniqueness 3. Meticulous IT controls must be in place to detect potential gaps in security across all the inputs, components and outputs of DLT WORLD ECONOMIC FORUM | 2016 35

The Future of Financial Infrastructure Page 34 Page 36

The Future of Financial Infrastructure Page 34 Page 36