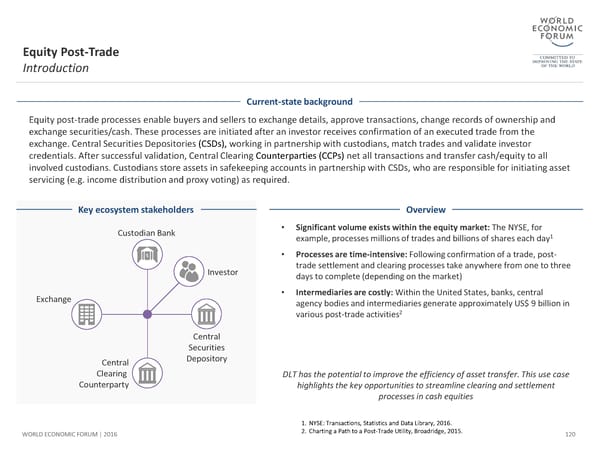

Equity Post-Trade Introduction Current-state background Equity post-trade processes enable buyers and sellers to exchange details, approve transactions, change records of ownership and exchange securities/cash. These processes are initiated after an investor receives confirmation of an executed trade from the exchange. Central Securities Depositories (CSDs), working in partnership with custodians, match trades and validate investor credentials. After successful validation, Central Clearing Counterparties (CCPs) net all transactions and transfer cash/equity to all involved custodians. Custodians store assets in safekeeping accounts in partnership with CSDs, who are responsible for initiating asset servicing (e.g. income distribution and proxy voting) as required. Key ecosystem stakeholders Overview Custodian Bank • Significant volume exists within the equity market: The NYSE, for example, processes millions of trades and billions of shares each day1 • Processes are time-intensive: Following confirmation of a trade, post- Investor trade settlement and clearing processes take anywhere from one to three days to complete (depending on the market) Exchange • Intermediaries are costly: Within the United States, banks, central agency bodies and intermediaries generate approximately US$ 9 billion in 2 various post-trade activities Central Securities Central Depository Clearing DLT has the potential to improve the efficiency of asset transfer. This use case Counterparty highlights the key opportunities to streamline clearing and settlement processes in cash equities 1. NYSE: Transactions, Statistics and Data Library, 2016. WORLD ECONOMIC FORUM | 2016 2. Charting a Path to a Post-Trade Utility, Broadridge, 2015. 120

The Future of Financial Infrastructure Page 119 Page 121

The Future of Financial Infrastructure Page 119 Page 121