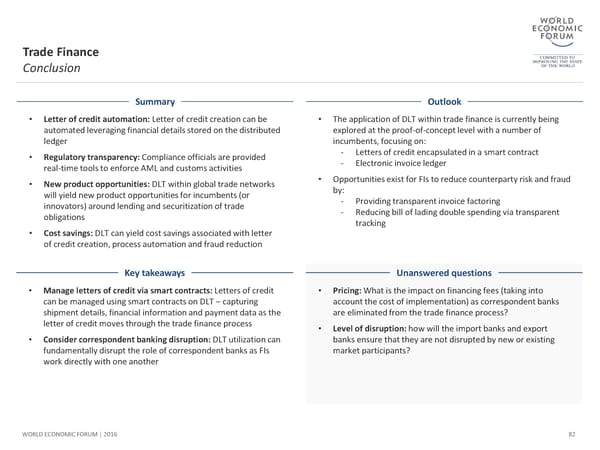

Trade Finance Conclusion Summary Outlook • Letter of credit automation: Letter of credit creation can be • The application of DLT within trade finance is currently being automated leveraging financial details stored on the distributed explored at the proof-of-concept level with a number of ledger incumbents, focusing on: • Regulatory transparency:Compliance officials are provided - Letters of credit encapsulated in a smart contract real-time tools to enforce AML and customs activities - Electronic invoice ledger • New product opportunities: DLT within global trade networks • Opportunities exist for FIs to reduce counterparty risk and fraud will yield new product opportunities for incumbents (or by: innovators) around lending and securitization of trade - Providing transparent invoice factoring obligations - Reducing bill of lading double spending via transparent tracking • Cost savings: DLT can yield cost savings associated with letter of credit creation, process automation and fraud reduction Key takeaways Unanswered questions • Manage letters of credit via smart contracts: Letters of credit • Pricing: What is the impact on financing fees (taking into can be managedusingsmartcontracts on DLT – capturing account the cost of implementation) as correspondent banks shipment details, financial information and payment data as the are eliminated from the trade finance process? letter of credit moves through the trade finance process • Level of disruption: how will the import banks and export • Consider correspondent banking disruption:DLT utilization can banks ensure that they are not disrupted by new or existing fundamentally disrupt the role of correspondent banks as FIs market participants? work directly with one another WORLD ECONOMIC FORUM | 2016 82

The Future of Financial Infrastructure Page 81 Page 83

The Future of Financial Infrastructure Page 81 Page 83