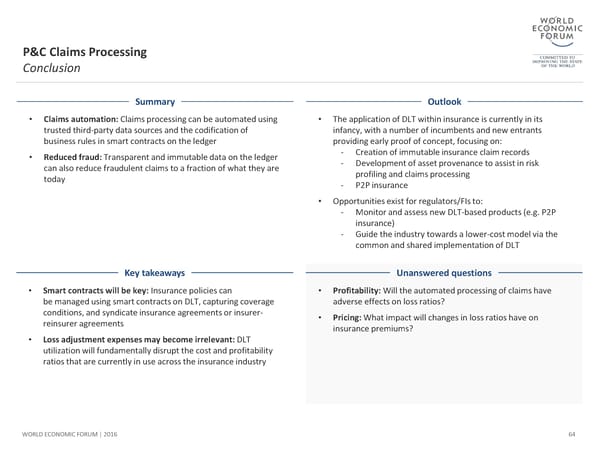

P&C Claims Processing Conclusion Summary Outlook • Claims automation:Claims processing can be automated using • The application of DLT within insurance is currently in its trusted third-party data sources and the codification of infancy, with a number of incumbents and new entrants business rules in smart contracts on the ledger providing early proof of concept, focusing on: • Reduced fraud:Transparentand immutable data on the ledger - Creation of immutable insurance claim records can also reduce fraudulent claims to a fraction of what they are - Development of asset provenance to assist in risk today profiling and claims processing - P2P insurance • Opportunities exist for regulators/FIs to: - Monitor and assess new DLT-based products (e.g. P2P insurance) - Guide the industry towards a lower-cost model via the common and shared implementation ofDLT Key takeaways Unanswered questions • Smart contracts will be key: Insurance policies can • Profitability: Will the automated processing of claims have bemanagedusingsmartcontracts on DLT, capturing coverage adverse effects on loss ratios? conditions, and syndicate insurance agreements or insurer- • Pricing: What impact will changes in loss ratios have on reinsurer agreements insurance premiums? • Loss adjustment expensesmay become irrelevant:DLT utilization will fundamentally disrupt the cost and profitability ratios that are currently in use across the insurance industry WORLD ECONOMIC FORUM | 2016 64

The Future of Financial Infrastructure Page 63 Page 65

The Future of Financial Infrastructure Page 63 Page 65