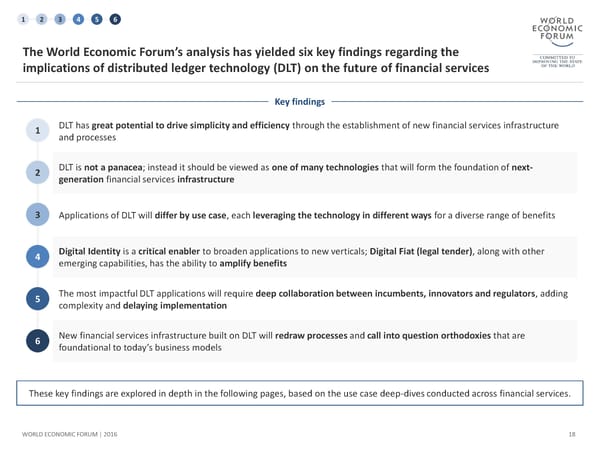

1 2 3 4 5 6 The World Economic Forum’s analysis has yielded six key findings regarding the implications of distributed ledger technology (DLT) on the future of financial services Key findings 1 DLT has great potential to drive simplicity and efficiency through the establishment of new financial services infrastructure and processes 2 DLT is not a panacea; instead it should be viewed as one of many technologies that will form the foundation of next- generation financial services infrastructure 3 Applications of DLT will differ by use case, each leveraging the technology in different ways for a diverse range of benefits 4 Digital Identity is a critical enabler to broaden applications to new verticals; Digital Fiat (legal tender), along with other emerging capabilities, has the ability to amplify benefits 5 The most impactful DLT applications will require deep collaboration between incumbents, innovators and regulators, adding complexity and delaying implementation 6 Newfinancial services infrastructure built on DLT will redraw processes and call into question orthodoxies that are foundational to today’s business models These key findings are explored in depth in the following pages, based on the use case deep-dives conducted across financial services. WORLD ECONOMIC FORUM | 2016 18

The Future of Financial Infrastructure Page 17 Page 19

The Future of Financial Infrastructure Page 17 Page 19