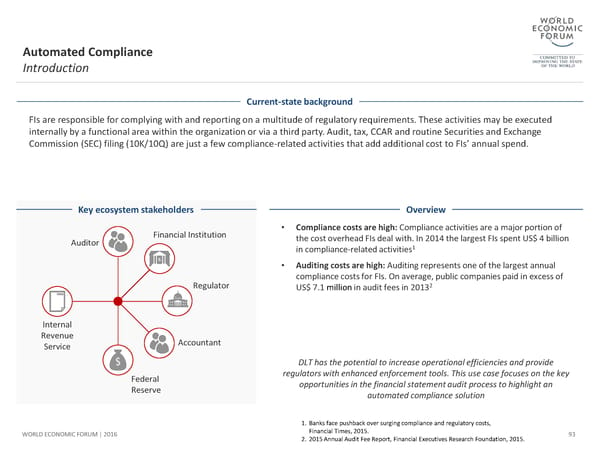

Automated Compliance Introduction Current-state background FIs are responsible for complying with and reporting on a multitude of regulatory requirements. These activities may be executed internally by a functional area within the organization or via a third party. Audit, tax, CCAR and routine Securities and Exchange Commission (SEC) filing (10K/10Q) are just a few compliance-related activities that add additional cost to FIs’ annual spend. Key ecosystem stakeholders Overview Financial Institution • Compliance costs are high: Compliance activities are a major portion of Auditor the cost overhead FIs deal with. In 2014 the largest FIs spent US$ 4 billion 1 in compliance-related activities • Auditing costs are high: Auditing represents one of the largest annual compliance costs for FIs. On average, public companies paid in excess of Regulator US$ 7.1 millionin audit fees in 20132 Internal Revenue Accountant Service DLT has the potential to increase operational efficiencies and provide Federal regulators with enhanced enforcement tools. This use case focuses on the key Reserve opportunities in the financial statement audit process to highlight an automated compliance solution 1. Banks face pushback over surging compliance and regulatory costs, WORLD ECONOMIC FORUM | 2016 Financial Times, 2015. 93 2. 2015 Annual Audit Fee Report, Financial Executives Research Foundation, 2015.

The Future of Financial Infrastructure Page 92 Page 94

The Future of Financial Infrastructure Page 92 Page 94