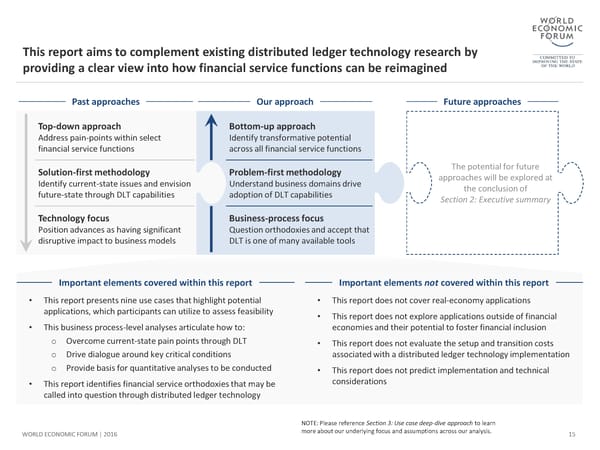

This report aims to complement existing distributed ledger technology research by providing a clear view into how financial service functions can be reimagined Past approaches Our approach Future approaches Top-down approach Bottom-up approach Address pain-points within select Identify transformative potential financial service functions across all financial service functions Solution-first methodology Problem-first methodology The potential for future Identify current-state issues and envision Understand business domains drive approaches will be explored at future-state through DLT capabilities adoption of DLT capabilities the conclusion of Section 2: Executive summary Technology focus Business-process focus Position advances as having significant Question orthodoxies and acceptthat disruptive impact to business models DLT is one of many available tools Important elements covered within this report Important elements not covered within this report • This report presents nine use cases that highlight potential • This report does not cover real-economy applications applications, which participants can utilize to assess feasibility • This report does not explore applications outside of financial • This business process-level analyses articulate how to: economies and their potential to foster financial inclusion o Overcome current-state pain points through DLT • This report does not evaluate the setup and transition costs o Drive dialogue around key critical conditions associated with a distributed ledger technology implementation o Provide basis for quantitative analyses to be conducted • This report does not predict implementation and technical • This report identifies financial service orthodoxies that may be considerations called into question through distributed ledger technology NOTE: Please reference Section 3: Use case deep-dive approach to learn WORLD ECONOMIC FORUM | 2016 more about our underlying focus and assumptions across our analysis. 15

The Future of Financial Infrastructure Page 14 Page 16

The Future of Financial Infrastructure Page 14 Page 16