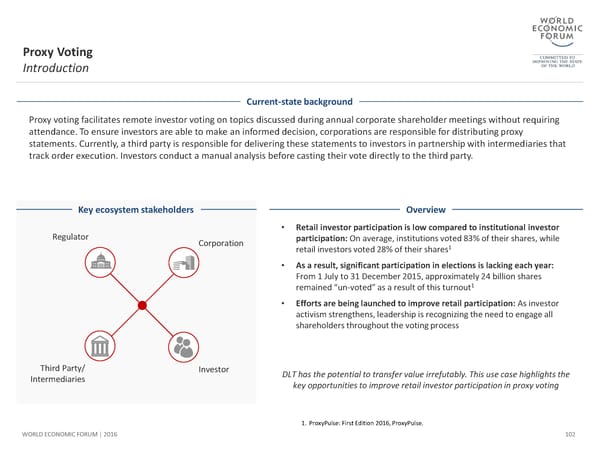

Proxy Voting Introduction Current-state background Proxy voting facilitates remote investor voting on topics discussed during annual corporate shareholder meetings without requiring attendance. To ensure investors are able to make an informed decision, corporations are responsible for distributing proxy statements. Currently, a third party is responsible for delivering these statements to investors in partnership with intermediaries that track order execution. Investors conduct a manual analysis before casting their vote directly to the third party. Key ecosystem stakeholders Overview • Retail investor participation is low compared to institutional investor Regulator Corporation participation: On average, institutions voted 83% of their shares, while retail investors voted 28% of their shares1 • As a result, significant participation in elections is lacking each year: From 1 July to 31 December 2015, approximately 24 billion shares remained “un-voted” as a result of this turnout1 • Efforts are being launched to improve retail participation: As investor activism strengthens, leadership is recognizing the need to engage all shareholders throughout the voting process Third Party/ Investor DLT has the potential to transfer value irrefutably. This use case highlights the Intermediaries key opportunities to improve retail investor participation in proxy voting 1. ProxyPulse: First Edition 2016, ProxyPulse. WORLD ECONOMIC FORUM | 2016 102

The Future of Financial Infrastructure Page 101 Page 103

The Future of Financial Infrastructure Page 101 Page 103