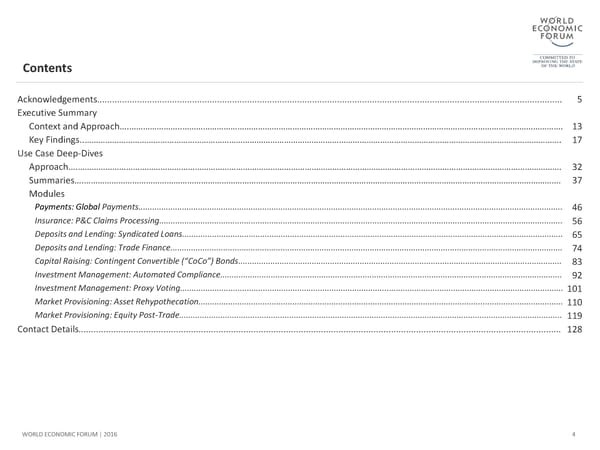

Contents Acknowledgements.......................................................................................................................................................................................... 5 Executive Summary Context and Approach….…………………..…………………………………………………………………………………………………………………………………………………. 13 Key Findings..………………………………………………………………………………………………………………………………………………………………………………………. 17 Use Case Deep-Dives Approach….…………………………………………………………………………………………………………………………………………………………………………………………. 32 Summaries….………………………………………………………………………………………………………………………………………………………………………………………. 37 Modules Payments: Global Payments......................................................................................................................................................................................... 46 Insurance: P&C Claims Processing................................................................................................................................................................................ 56 Deposits and Lending: Syndicated Loans...................................................................................................................................................................... 65 Deposits and Lending: Trade Finance........................................................................................................................................................................... 74 Capital Raising: Contingent Convertible(“CoCo”) Bonds............................................................................................................................................. 83 Investment Management: Automated Compliance..................................................................................................................................................... 92 Investment Management: Proxy Voting....................................................................................................................................................................... 101 Market Provisioning:Asset Rehypothecation............................................................................................................................................................... 110 Market Provisioning: Equity Post-Trade....................................................................................................................................................................... 119 Contact Details................................................................................................................................................................................................. 128 WORLD ECONOMIC FORUM | 2016 4

The Future of Financial Infrastructure Page 3 Page 5

The Future of Financial Infrastructure Page 3 Page 5