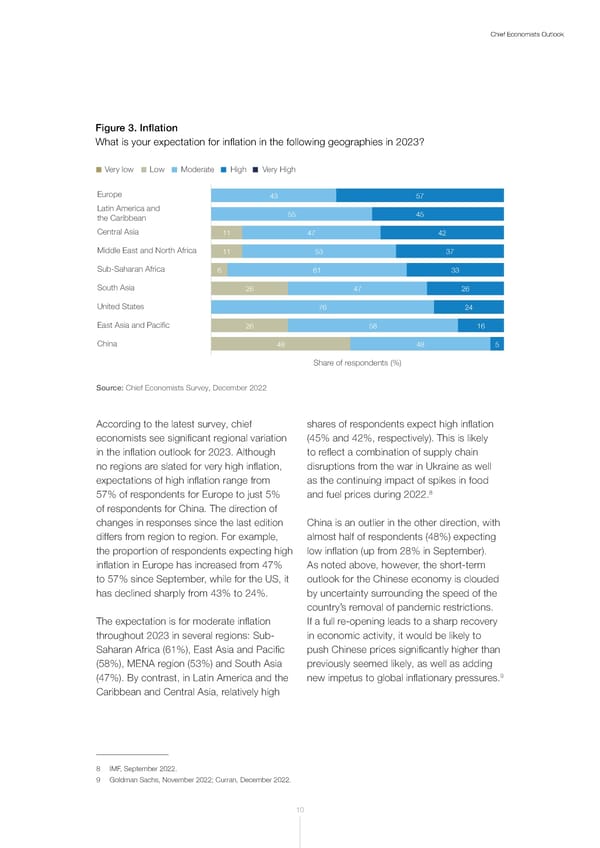

10 Chief Economists Outlook Figure 3. Inflation What is your expectation for inflation in the following geographies in 2023? Very low Low Moderate High Very High Share of respondents (%) Share of respondents (%) Europe Latin America and the Caribbean Central Asia Middle East and North Africa Sub-Saharan Africa South Asia United States East Asia and Pacific China 5 43 57 55 11 11 6 26 76 26 58 16 48 48 5 24 47 26 61 33 47 53 37 42 45 Source: Chief Economists Survey, December 2022 According to the latest survey, chief economists see significant regional variation in the inflation outlook for 2023. Although no regions are slated for very high inflation, expectations of high inflation range from 57% of respondents for Europe to just 5% of respondents for China. The direction of changes in responses since the last edition differs from region to region. For example, the proportion of respondents expecting high inflation in Europe has increased from 47% to 57% since September, while for the US, it has declined sharply from 43% to 24%. The expectation is for moderate inflation throughout 2023 in several regions: Sub- Saharan Africa (61%), East Asia and Pacific (58%), MENA region (53%) and South Asia (47%). By contrast, in Latin America and the Caribbean and Central Asia, relatively high shares of respondents expect high inflation (45% and 42%, respectively). This is likely to reflect a combination of supply chain disruptions from the war in Ukraine as well as the continuing impact of spikes in food and fuel prices during 2022. 8 China is an outlier in the other direction, with almost half of respondents (48%) expecting low inflation (up from 28% in September). As noted above, however, the short-term outlook for the Chinese economy is clouded by uncertainty surrounding the speed of the country’s removal of pandemic restrictions. If a full re-opening leads to a sharp recovery in economic activity, it would be likely to push Chinese prices significantly higher than previously seemed likely, as well as adding new impetus to global inflationary pressures. 9 8 IMF, September 2022. 9 Goldman Sachs, November 2022; Curran, December 2022.

WEF Chief Economists Outlook 2023 Page 9 Page 11

WEF Chief Economists Outlook 2023 Page 9 Page 11