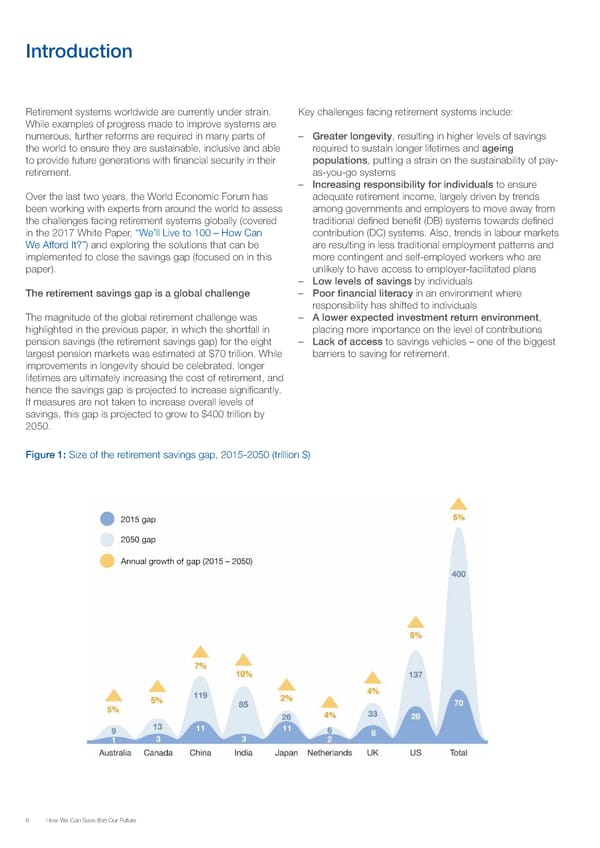

Introduction Retirement systems worldwide are currently under strain. Key challenges facing retirement systems include: While examples of progress made to improve systems are numerous, further reforms are required in many parts of – Greater longevity, resulting in higher levels of savings the world to ensure they are sustainable, inclusive and able required to sustain longer lifetimes and ageing to provide future generations with financial security in their populations, putting a strain on the sustainability of pay- retirement. as-you-go systems – Increasing responsibility for individuals to ensure Over the last two years, the World Economic Forum has adequate retirement income, largely driven by trends been working with experts from around the world to assess among governments and employers to move away from the challenges facing retirement systems globally (covered traditional defined benefit (DB) systems towards defined in the 2017 White Paper, “We’ll Live to 100 – How Can contribution (DC) systems. Also, trends in labour markets We Afford It?”) and exploring the solutions that can be are resulting in less traditional employment patterns and implemented to close the savings gap (focused on in this more contingent and self-employed workers who are paper). unlikely to have access to employer-facilitated plans – Low levels of savings by individuals The retirement savings gap is a global challenge – Poor financial literacy in an environment where responsibility has shifted to individuals The magnitude of the global retirement challenge was – A lower expected investment return environment, highlighted in the previous paper, in which the shortfall in placing more importance on the level of contributions pension savings (the retirement savings gap) for the eight – Lack of access to savings vehicles – one of the biggest largest pension markets was estimated at $70 trillion. While barriers to saving for retirement. improvements in longevity should be celebrated, longer lifetimes are ultimately increasing the cost of retirement, and hence the savings gap is projected to increase significantly. If measures are not taken to increase overall levels of savings, this gap is projected to grow to $400 trillion by 2050. Figure 1: Size of the retirement savings gap, 2015-2050 (trillion $) 6 How We Can Save (for) Our Future

How can we save for our future Page 5 Page 7

How can we save for our future Page 5 Page 7