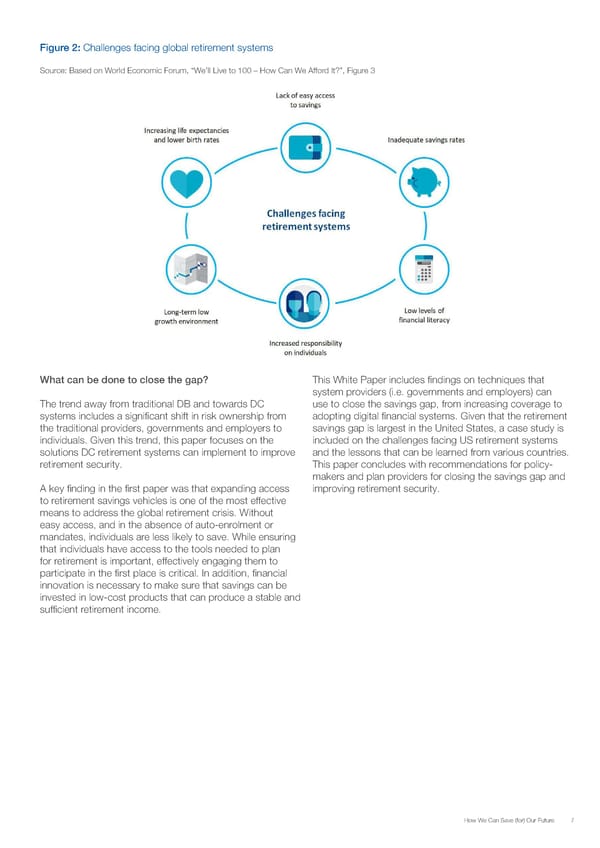

Figure 2: Challenges facing global retirement systems Source: Based on World Economic Forum, “We’ll Live to 100 – How Can We Afford It?”, Figure 3 What can be done to close the gap? This White Paper includes findings on techniques that system providers (i.e. governments and employers) can The trend away from traditional DB and towards DC use to close the savings gap, from increasing coverage to systems includes a significant shift in risk ownership from adopting digital financial systems. Given that the retirement the traditional providers, governments and employers to savings gap is largest in the United States, a case study is individuals. Given this trend, this paper focuses on the included on the challenges facing US retirement systems solutions DC retirement systems can implement to improve and the lessons that can be learned from various countries. retirement security. This paper concludes with recommendations for policy- makers and plan providers for closing the savings gap and A key finding in the first paper was that expanding access improving retirement security. to retirement savings vehicles is one of the most effective means to address the global retirement crisis. Without easy access, and in the absence of auto-enrolment or mandates, individuals are less likely to save. While ensuring that individuals have access to the tools needed to plan for retirement is important, effectively engaging them to participate in the first place is critical. In addition, financial innovation is necessary to make sure that savings can be invested in low-cost products that can produce a stable and sufficient retirement income. How We Can Save (for) Our Future 7

How can we save for our future Page 6 Page 8

How can we save for our future Page 6 Page 8