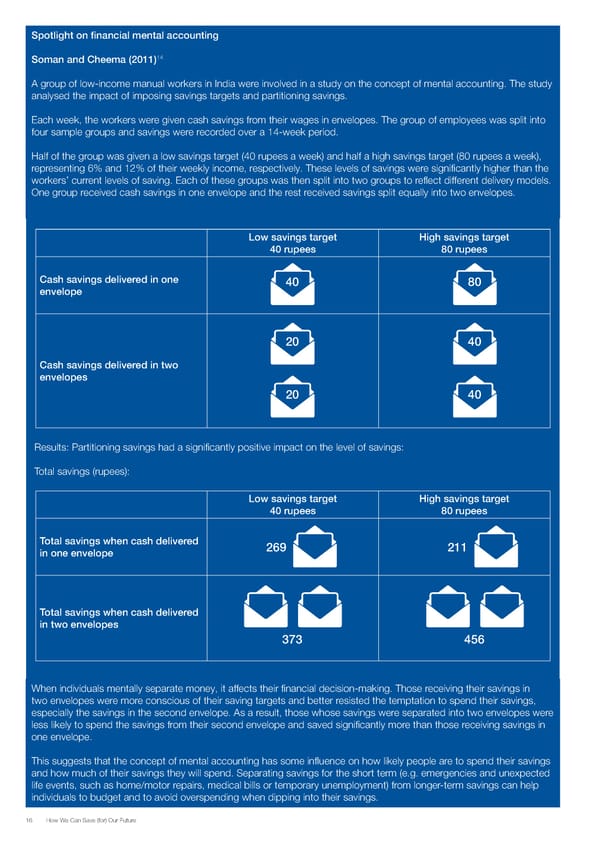

Spotlight on financial mental accounting Soman and Cheema (2011)14 A group of low-income manual workers in India were involved in a study on the concept of mental accounting. The study analysed the impact of imposing savings targets and partitioning savings. Each week, the workers were given cash savings from their wages in envelopes. The group of employees was split into four sample groups and savings were recorded over a 14-week period. Half of the group was given a low savings target (40 rupees a week) and half a high savings target (80 rupees a week), representing 6% and 12% of their weekly income, respectively. These levels of savings were significantly higher than the workers’ current levels of saving. Each of these groups was then split into two groups to reflect different delivery models. One group received cash savings in one envelope and the rest received savings split equally into two envelopes. Low savings target High savings target 40 rupees 80 rupees Cash savings delivered in one 40 80 envelope 20 40 Cash savings delivered in two envelopes 20 40 Results: Partitioning savings had a significantly positive impact on the level of savings: Total savings (rupees): Low savings target High savings target 40 rupees 80 rupees Total savings when cash delivered 269 211 in one envelope Total savings when cash delivered in two envelopes 373 456 When individuals mentally separate money, it affects their financial decision-making. Those receiving their savings in two envelopes were more conscious of their saving targets and better resisted the temptation to spend their savings, especially the savings in the second envelope. As a result, those whose savings were separated into two envelopes were less likely to spend the savings from their second envelope and saved significantly more than those receiving savings in one envelope. This suggests that the concept of mental accounting has some influence on how likely people are to spend their savings and how much of their savings they will spend. Separating savings for the short term (e.g. emergencies and unexpected life events, such as home/motor repairs, medical bills or temporary unemployment) from longer-term savings can help individuals to budget and to avoid overspending when dipping into their savings. 16 How We Can Save (for) Our Future

How can we save for our future Page 15 Page 17

How can we save for our future Page 15 Page 17