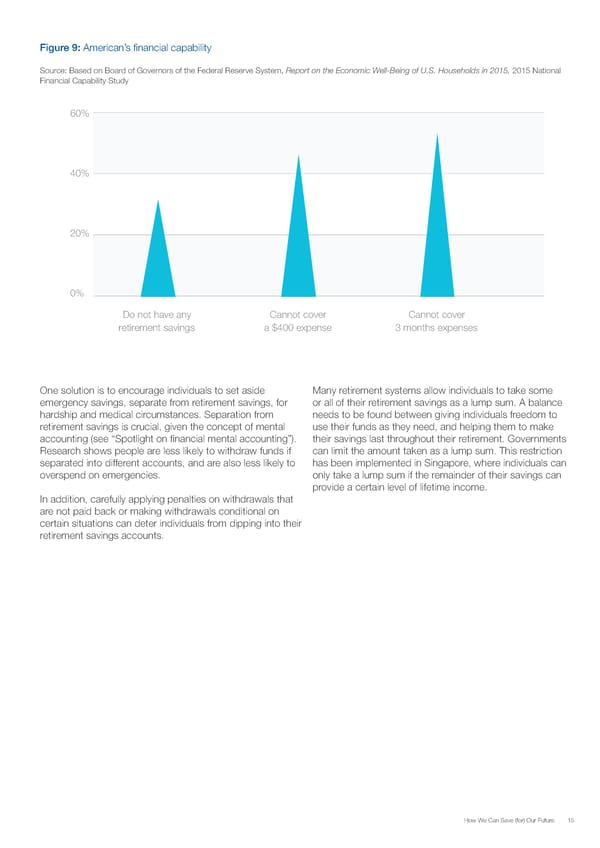

Figure 9: American’s financial capability Source: Based on Board of Governors of the Federal Reserve System, Report on the Economic Well-Being of U.S. Households in 2015, 2015 National Financial Capability Study 60% 40% 20% 0% Do not have any Cannot cover Cannot cover retirement savings a $400 expense 3 months expenses One solution is to encourage individuals to set aside Many retirement systems allow individuals to take some emergency savings, separate from retirement savings, for or all of their retirement savings as a lump sum. A balance hardship and medical circumstances. Separation from needs to be found between giving individuals freedom to retirement savings is crucial, given the concept of mental use their funds as they need, and helping them to make accounting (see “Spotlight on financial mental accounting”). their savings last throughout their retirement. Governments Research shows people are less likely to withdraw funds if can limit the amount taken as a lump sum. This restriction separated into different accounts, and are also less likely to has been implemented in Singapore, where individuals can overspend on emergencies. only take a lump sum if the remainder of their savings can provide a certain level of lifetime income. In addition, carefully applying penalties on withdrawals that are not paid back or making withdrawals conditional on certain situations can deter individuals from dipping into their retirement savings accounts. How We Can Save (for) Our Future 15

How can we save for our future Page 14 Page 16

How can we save for our future Page 14 Page 16