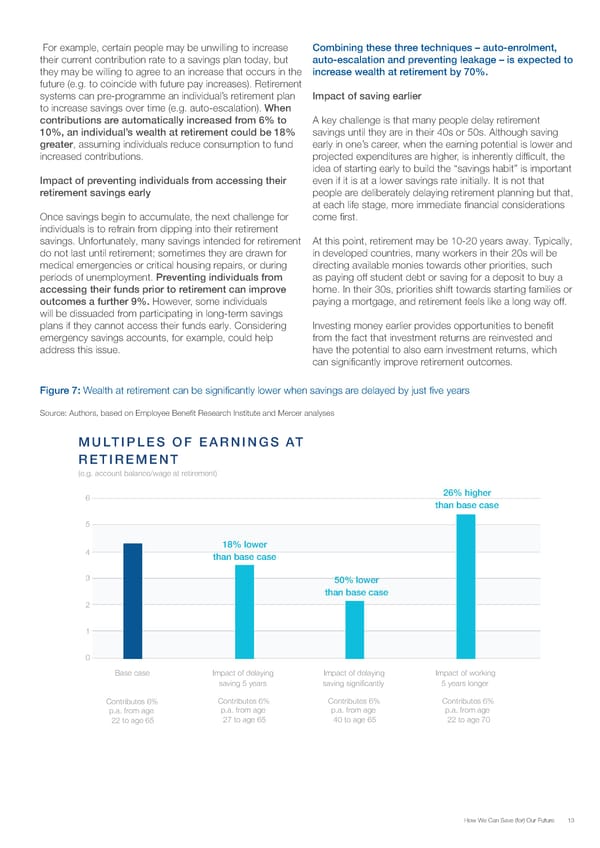

For example, certain people may be unwilling to increase Combining these three techniques – auto-enrolment, their current contribution rate to a savings plan today, but auto-escalation and preventing leakage – is expected to they may be willing to agree to an increase that occurs in the increase wealth at retirement by 70%. future (e.g. to coincide with future pay increases). Retirement systems can pre-programme an individual’s retirement plan Impact of saving earlier to increase savings over time (e.g. auto-escalation). When contributions are automatically increased from 6% to A key challenge is that many people delay retirement 10%, an individual’s wealth at retirement could be 18% savings until they are in their 40s or 50s. Although saving greater, assuming individuals reduce consumption to fund early in one’s career, when the earning potential is lower and increased contributions. projected expenditures are higher, is inherently difficult, the idea of starting early to build the “savings habit” is important Impact of preventing individuals from accessing their even if it is at a lower savings rate initially. It is not that retirement savings early people are deliberately delaying retirement planning but that, at each life stage, more immediate financial considerations Once savings begin to accumulate, the next challenge for come first. individuals is to refrain from dipping into their retirement savings. Unfortunately, many savings intended for retirement At this point, retirement may be 10-20 years away. Typically, do not last until retirement; sometimes they are drawn for in developed countries, many workers in their 20s will be medical emergencies or critical housing repairs, or during directing available monies towards other priorities, such periods of unemployment. Preventing individuals from as paying off student debt or saving for a deposit to buy a accessing their funds prior to retirement can improve home. In their 30s, priorities shift towards starting families or outcomes a further 9%. However, some individuals paying a mortgage, and retirement feels like a long way off. will be dissuaded from participating in long-term savings plans if they cannot access their funds early. Considering Investing money earlier provides opportunities to benefit emergency savings accounts, for example, could help from the fact that investment returns are reinvested and address this issue. have the potential to also earn investment returns, which can significantly improve retirement outcomes. Figure 7: Wealth at retirement can be significantly lower when savings are delayed by just five years Source: Authors, based on Employee Benefit Research Institute and Mercer analyses MULTIPLES OF EARNINGS AT RETIREMENT (e.g. account balance/wage at retirement) 6 26% higher than base case 5 18% lower 4 than base case 3 50% lower than base case 2 1 0 Base case Impact of delaying Impact of delaying Impact of working saving 5 years saving significantly 5 years longer Contributes 6% Contributes 6% Contributes 6% Contributes 6% p.a. from age p.a. from age p.a. from age p.a. from age 27 to age 65 40 to age 65 22 to age 70 22 to age 65 How We Can Save (for) Our Future 13

How can we save for our future Page 12 Page 14

How can we save for our future Page 12 Page 14