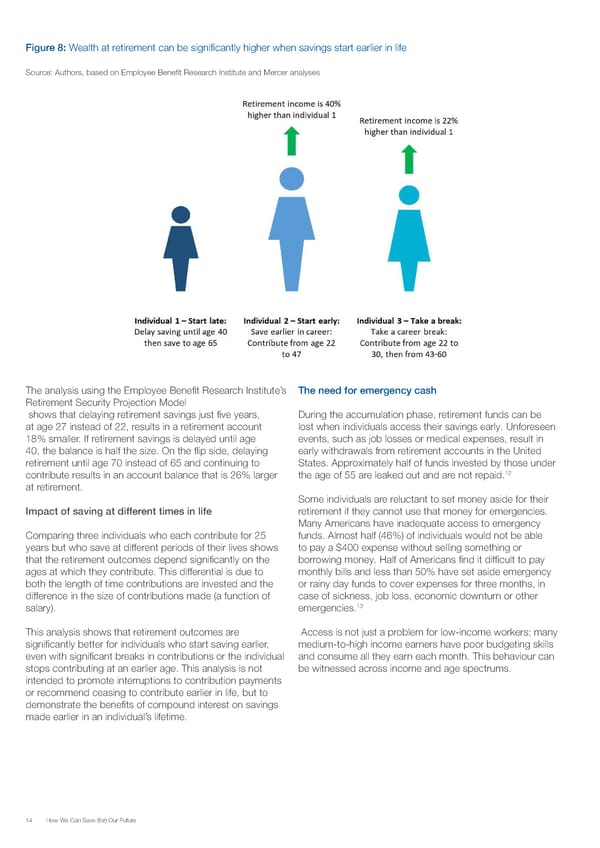

Figure 8: Wealth at retirement can be significantly higher when savings start earlier in life Source: Authors, based on Employee Benefit Research Institute and Mercer analyses The analysis using the Employee Benefit Research Institute’s The need for emergency cash Retirement Security Projection Model shows that delaying retirement savings just five years, During the accumulation phase, retirement funds can be at age 27 instead of 22, results in a retirement account lost when individuals access their savings early. Unforeseen 18% smaller. If retirement savings is delayed until age events, such as job losses or medical expenses, result in 40, the balance is half the size. On the flip side, delaying early withdrawals from retirement accounts in the United retirement until age 70 instead of 65 and continuing to States. Approximately half of funds invested by those under 12 contribute results in an account balance that is 26% larger the age of 55 are leaked out and are not repaid. at retirement. Some individuals are reluctant to set money aside for their Impact of saving at different times in life retirement if they cannot use that money for emergencies. Many Americans have inadequate access to emergency Comparing three individuals who each contribute for 25 funds. Almost half (46%) of individuals would not be able years but who save at different periods of their lives shows to pay a $400 expense without selling something or that the retirement outcomes depend significantly on the borrowing money. Half of Americans find it difficult to pay ages at which they contribute. This differential is due to monthly bills and less than 50% have set aside emergency both the length of time contributions are invested and the or rainy day funds to cover expenses for three months, in difference in the size of contributions made (a function of case of sickness, job loss, economic downturn or other 13 salary). emergencies. This analysis shows that retirement outcomes are Access is not just a problem for low-income workers; many significantly better for individuals who start saving earlier, medium-to-high income earners have poor budgeting skills even with significant breaks in contributions or the individual and consume all they earn each month. This behaviour can stops contributing at an earlier age. This analysis is not be witnessed across income and age spectrums. intended to promote interruptions to contribution payments or recommend ceasing to contribute earlier in life, but to demonstrate the benefits of compound interest on savings made earlier in an individual’s lifetime. 14 How We Can Save (for) Our Future

How can we save for our future Page 13 Page 15

How can we save for our future Page 13 Page 15