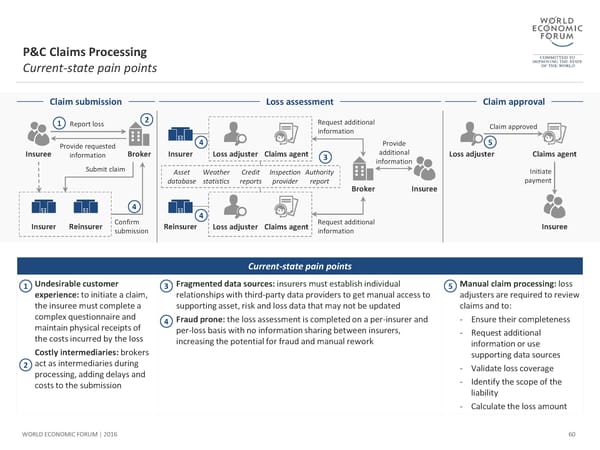

P&C Claims Processing Current-state pain points Claim submission Loss assessment Claim approval 1 Report loss 2 Request additional Claim approved information Provide requested 4 Provide 5 Insuree information Broker Insurer Loss adjuster Claims agent 3 additional Loss adjuster Claims agent information Submit claim Asset Weather Credit Inspection Authority Initiate database statistics reports provider report payment Broker Insuree 4 Confirm 4 Request additional Insurer Reinsurer submission Reinsurer Loss adjuster Claims agent information Insuree Current-state pain points 1 Undesirable customer 3 Fragmented data sources: insurers must establish individual 5 Manual claimprocessing: loss experience: to initiate a claim, relationships with third-party data providers to get manual access to adjusters are required to review the insuree must complete a supporting asset, risk and loss data that may not be updated claims and to: complex questionnaire and 4 Fraud prone: theloss assessment is completed on a per-insurer and - Ensure their completeness maintain physical receipts of per-loss basis with no information sharing between insurers, - Request additional the costs incurred by the loss increasing the potential for fraud and manual rework information or use Costly intermediaries: brokers supporting data sources 2 act as intermediaries during - Validate loss coverage processing, adding delays and - Identify the scope of the costs to the submission liability - Calculatethe loss amount WORLD ECONOMIC FORUM | 2016 60

The Future of Financial Infrastructure Page 59 Page 61

The Future of Financial Infrastructure Page 59 Page 61