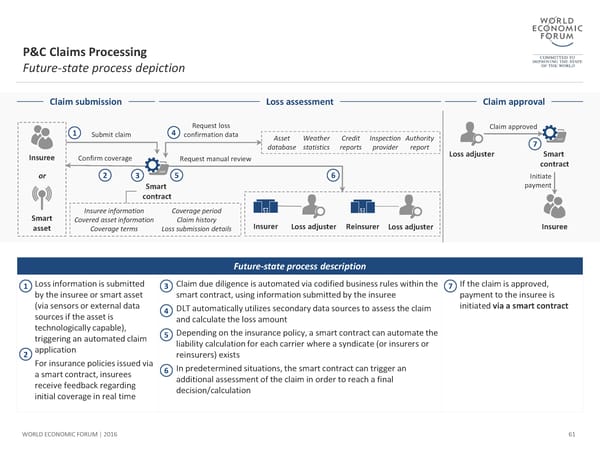

P&C Claims Processing Future-state process depiction Claim submission Loss assessment Claim approval 1 4 Request loss Claim approved Submit claim confirmation data Asset Weather Credit Inspection Authority database statistics reports provider report 7 Insuree Confirm coverage Request manual review Loss adjuster Smart contract or 2 3 5 6 Initiate Smart payment contract Smart Insuree information Coverage period Covered asset information Claim history Insurer Loss adjuster Reinsurer Loss adjuster Insuree asset Coverage terms Loss submission details Future-state process description 1 Loss information is submitted 3 Claim due diligence is automated via codified business rules within the 7 If the claim is approved, by the insuree or smart asset smart contract, using information submitted by the insuree payment to the insuree is (via sensors or external data 4 DLT automatically utilizes secondary data sources to assess the claim initiated via a smart contract sources if the asset is and calculate the loss amount technologically capable), 5 Depending on the insurance policy, a smart contract can automate the triggering an automated claim liability calculation for each carrier where a syndicate (or insurers or 2 application reinsurers) exists For insurance policies issued via 6 In predetermined situations, the smart contract can trigger an a smart contract, insurees additional assessment of the claim in order to reach a final receive feedback regarding decision/calculation initial coverage in real time WORLD ECONOMIC FORUM | 2016 61

The Future of Financial Infrastructure Page 60 Page 62

The Future of Financial Infrastructure Page 60 Page 62