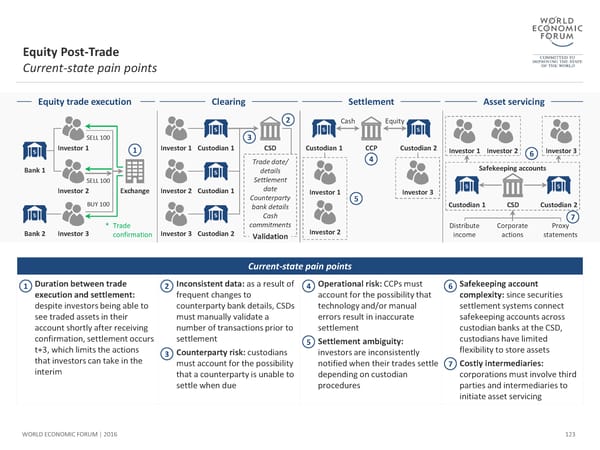

Equity Post-Trade Current-state pain points Equity trade execution Clearing Settlement Asset servicing 2 Cash Equity SELL 100 3 Investor 1 1 Investor 1 Custodian 1 CSD Custodian 1 CCP Custodian 2 Investor 1 Investor 2 6 Investor 3 Trade date/ 4 Bank 1 details Safekeeping accounts SELL 100 Settlement Investor 2 Exchange Investor 2 Custodian 1 date Investor 1 Investor 3 BUY 100 Counterparty 5 Custodian 1 CSD Custodian 2 bank details Cash 7 * Trade commitments Investor 2 Distribute Corporate Proxy Bank 2 Investor 3 confirmation Investor 3 Custodian 2 Validation income actions statements Current-state pain points 1 Duration between trade 2 Inconsistent data: as a result of 4 Operational risk: CCPsmust 6 Safekeeping account execution and settlement: frequent changes to account for the possibility that complexity: since securities despite investors being able to counterparty bank details, CSDs technology and/or manual settlement systems connect see traded assets in their must manually validate a errors result in inaccurate safekeeping accounts across account shortly after receiving number of transactions prior to settlement custodian banks at the CSD, confirmation, settlement occurs settlement 5 Settlement ambiguity: custodians have limited t+3, which limits the actions 3 Counterpartyrisk: custodians investors are inconsistently flexibility to store assets that investors can take in the must account for the possibility notified when their trades settle 7 Costly intermediaries: interim that a counterparty is unable to depending on custodian corporations must involve third settle when due procedures parties and intermediaries to initiate asset servicing WORLD ECONOMIC FORUM | 2016 123

The Future of Financial Infrastructure Page 122 Page 124

The Future of Financial Infrastructure Page 122 Page 124