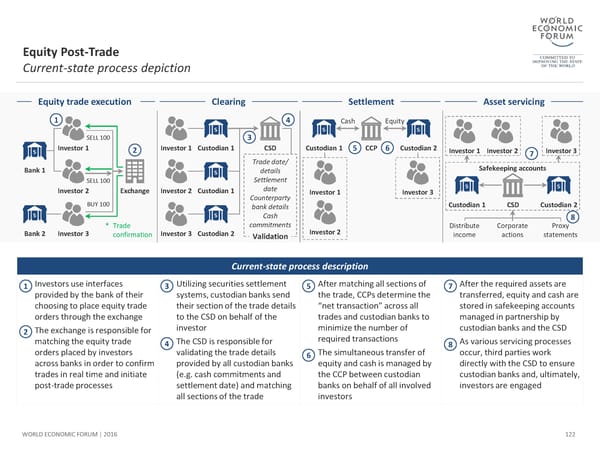

Equity Post-Trade Current-state process depiction Equity trade execution Clearing Settlement Asset servicing 1 4 Cash Equity SELL 100 3 Investor 1 2 Investor 1 Custodian 1 CSD Custodian 1 5 CCP 6 Custodian 2 Investor 1 Investor 2 7 Investor 3 Trade date/ Safekeeping accounts Bank 1 details SELL 100 Settlement Investor 2 Exchange Investor 2 Custodian 1 date Investor 1 Investor 3 BUY 100 Counterparty Custodian 1 CSD Custodian 2 bank details Cash 8 * Trade commitments Investor 2 Distribute Corporate Proxy Bank 2 Investor 3 confirmation Investor 3 Custodian 2 Validation income actions statements Current-state process description 1 Investors use interfaces 3 Utilizing securities settlement 5 After matching all sections of 7 After the required assets are provided by the bank of their systems, custodian banks send the trade, CCPs determine the transferred, equity and cash are choosing to place equity trade their section of the trade details “net transaction” across all stored in safekeepingaccounts orders through the exchange to the CSD on behalf of the trades and custodianbanks to managed in partnership by 2 The exchange is responsible for investor minimize the number of custodian banks and the CSD matching the equity trade 4 The CSD is responsible for required transactions 8 As various servicing processes orders placed by investors validating the trade details 6 The simultaneous transfer of occur, third parties work across banks in order to confirm provided by all custodian banks equity and cash is managed by directly with the CSD to ensure trades in real time and initiate (e.g. cash commitments and the CCP between custodian custodian banks and, ultimately, post-trade processes settlement date) and matching banks on behalf of all involved investors are engaged all sections of the trade investors WORLD ECONOMIC FORUM | 2016 122

The Future of Financial Infrastructure Page 121 Page 123

The Future of Financial Infrastructure Page 121 Page 123