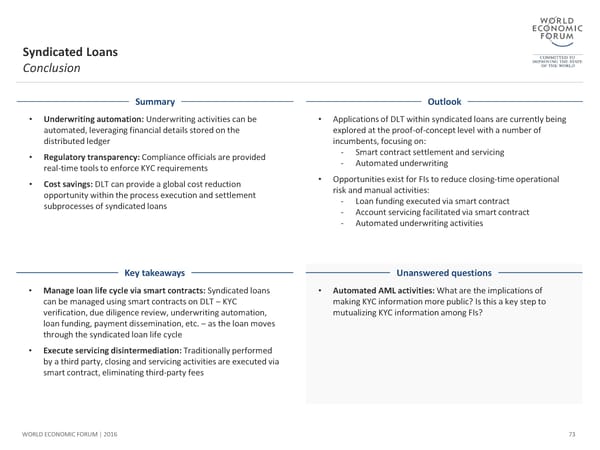

Syndicated Loans Conclusion Summary Outlook • Underwriting automation: Underwriting activities can be • Applications of DLT within syndicated loans are currently being automated, leveraging financial details stored on the explored at the proof-of-concept level with a number of distributed ledger incumbents, focusing on: • Regulatory transparency:Compliance officials are provided - Smart contract settlement and servicing real-time tools to enforce KYC requirements - Automated underwriting • Cost savings: DLT can provide a globalcost reduction • Opportunities exist for FIs to reduce closing-time operational opportunitywithin the process execution and settlement risk and manual activities: subprocesses of syndicated loans - Loan funding executed via smart contract - Account servicing facilitated via smart contract - Automated underwriting activities Key takeaways Unanswered questions • Manage loan life cycle via smart contracts: Syndicated loans • Automated AML activities: What are the implications of can be managedusingsmartcontracts on DLT – KYC making KYC information more public? Is this a key step to verification, due diligence review, underwriting automation, mutualizing KYC information among FIs? loan funding, payment dissemination, etc. – as the loan moves through the syndicated loan life cycle • Execute servicing disintermediation:Traditionally performed by a third party, closing and servicing activities are executed via smart contract, eliminating third-party fees WORLD ECONOMIC FORUM | 2016 73

The Future of Financial Infrastructure Page 72 Page 74

The Future of Financial Infrastructure Page 72 Page 74