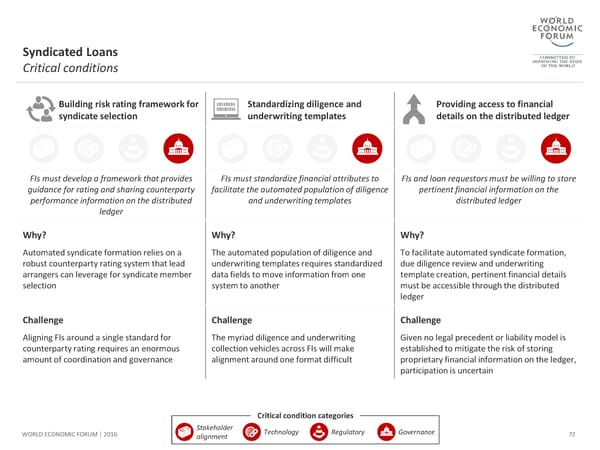

Syndicated Loans Critical conditions Building risk rating framework for Standardizing diligence and Providing access to financial syndicate selection underwriting templates details on the distributed ledger FIs must develop a framework that provides FIs must standardize financial attributes to FIs and loan requestors must be willing to store guidance for rating and sharing counterparty facilitate the automated population of diligence pertinent financial information on the performance information on the distributed and underwriting templates distributed ledger ledger Why? Why? Why? Automated syndicate formation relies on a The automated population of diligence and To facilitate automated syndicate formation, robust counterparty rating system that lead underwriting templates requires standardized due diligence review and underwriting arrangers can leverage for syndicate member data fields to move information from one template creation, pertinent financial details selection system to another must be accessible through the distributed ledger Challenge Challenge Challenge Aligning FIs around a single standard for The myriad diligence and underwriting Given no legal precedent or liability model is counterparty rating requires an enormous collection vehicles across FIs will make established to mitigate the risk of storing amount of coordination and governance alignment around one format difficult proprietary financial information on the ledger, participation is uncertain Critical condition categories WORLD ECONOMIC FORUM | 2016 Stakeholder Technology Regulatory Governance 72 alignment

The Future of Financial Infrastructure Page 71 Page 73

The Future of Financial Infrastructure Page 71 Page 73