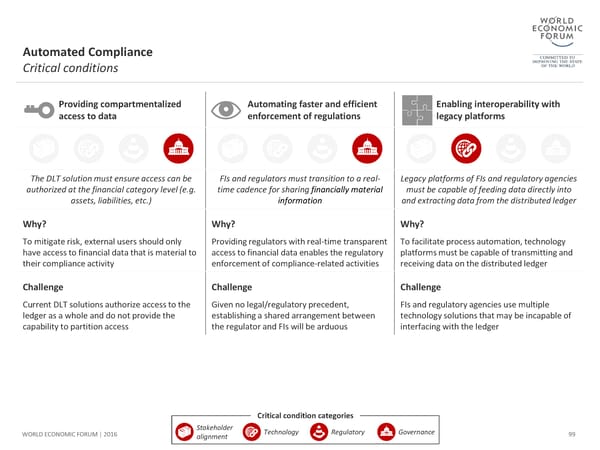

Automated Compliance Critical conditions Providing compartmentalized Automatingfaster and efficient Enabling interoperability with access to data enforcement of regulations legacy platforms The DLT solution must ensure access can be FIs and regulators must transition to a real- Legacy platforms of FIs and regulatory agencies authorized at the financial category level (e.g. time cadence for sharing financially material must be capable of feeding data directly into assets, liabilities, etc.) information and extracting data from the distributed ledger Why? Why? Why? To mitigate risk, external users should only Providing regulators with real-time transparent To facilitate process automation, technology have access to financial data that is material to access to financial data enables the regulatory platforms must be capable of transmitting and their compliance activity enforcement of compliance-related activities receiving data on the distributed ledger Challenge Challenge Challenge Current DLT solutions authorize access to the Given no legal/regulatory precedent, FIs and regulatory agencies use multiple ledger as a whole and do not provide the establishing a shared arrangement between technology solutions that may be incapable of capability to partition access the regulator and FIs will be arduous interfacing with the ledger Critical condition categories WORLD ECONOMIC FORUM | 2016 Stakeholder Technology Regulatory Governance 99 alignment

The Future of Financial Infrastructure Page 98 Page 100

The Future of Financial Infrastructure Page 98 Page 100