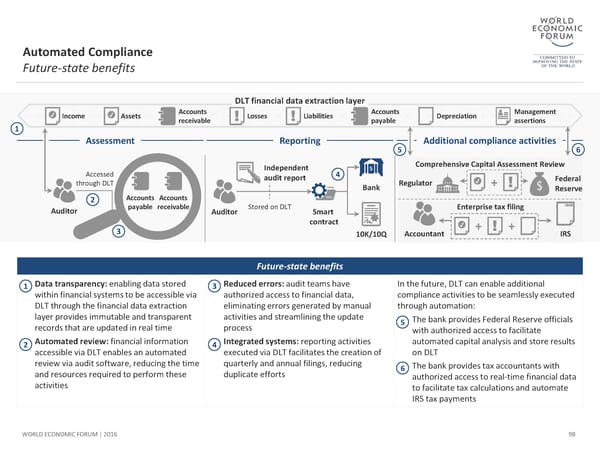

Automated Compliance Future-state benefits DLT financial data extraction layer Income Assets Accounts Losses Liabilities Accounts Depreciation Management receivable payable assertions 1 Assessment Reporting Additional compliance activities 5 6 Independent Comprehensive Capital Assessment Review Accessed audit report 4 Federal through DLT Bank Regulator + Reserve 2 Accounts Accounts Auditor payable receivable Auditor Stored on DLT Smart Enterprise tax filing contract + + 3 10K/10Q Accountant IRS Future-state benefits 1 Data transparency: enabling data stored 3 Reduced errors: audit teams have In the future, DLT can enable additional within financial systems to be accessible via authorizedaccess to financial data, compliance activities to be seamlessly executed DLT through the financial data extraction eliminating errors generated by manual through automation: layer provides immutable and transparent activities and streamlining the update • The bank provides Federal Reserve officials records that are updated in real time process 5 with authorized access to facilitate 2 Automated review: financialinformation 4 Integrated systems: reporting activities automated capital analysis and store results accessible via DLT enables an automated executed via DLT facilitates the creation of on DLT review via audit software, reducing the time quarterly and annual filings, reducing • Thebank provides tax accountants with and resources required to perform these duplicate efforts 6 authorized access to real-time financial data activities to facilitate tax calculations and automate IRS tax payments WORLD ECONOMIC FORUM | 2016 98

The Future of Financial Infrastructure Page 97 Page 99

The Future of Financial Infrastructure Page 97 Page 99