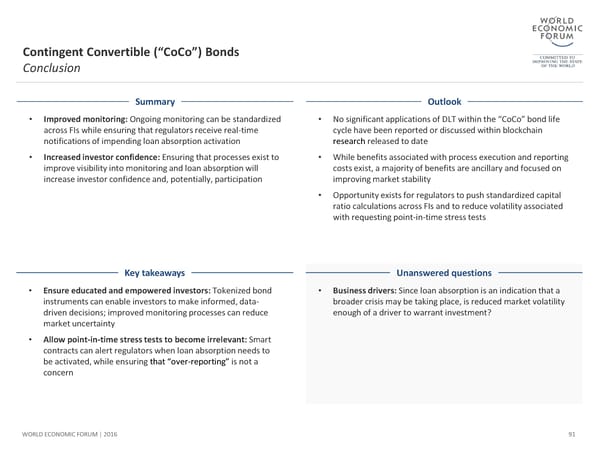

Contingent Convertible (“CoCo”) Bonds Conclusion Summary Outlook • Improved monitoring: Ongoing monitoring can be standardized • No significant applications of DLT within the “CoCo” bond life across FIs while ensuring that regulators receive real-time cycle have been reported or discussed within blockchain notifications of impending loan absorption activation researchreleased to date • Increased investor confidence: Ensuring that processes exist to • While benefits associated with process execution and reporting improve visibility into monitoring and loan absorption will costs exist, a majority of benefits are ancillary and focused on increase investor confidence and, potentially, participation improving market stability • Opportunity exists for regulators to push standardized capital ratio calculations across FIs and to reduce volatility associated with requesting point-in-time stress tests Key takeaways Unanswered questions • Ensure educated and empowered investors: Tokenized bond • Business drivers:Since loan absorption is an indication that a instruments can enable investors to make informed, data- broader crisis may be taking place, is reduced market volatility driven decisions; improved monitoring processes can reduce enough of a driver to warrant investment? market uncertainty • Allow point-in-time stress tests to become irrelevant: Smart contracts can alert regulators when loan absorption needs to be activated, while ensuring that “over-reporting” is not a concern WORLD ECONOMIC FORUM | 2016 91

The Future of Financial Infrastructure Page 90 Page 92

The Future of Financial Infrastructure Page 90 Page 92