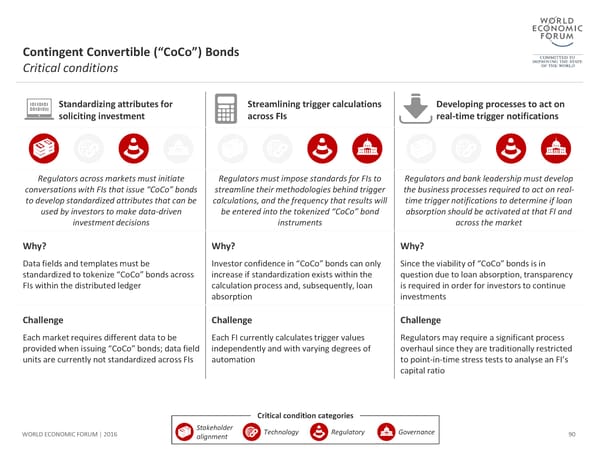

Contingent Convertible (“CoCo”) Bonds Critical conditions Standardizing attributes for Streamlining trigger calculations Developing processes to act on soliciting investment across FIs real-time trigger notifications Regulators across markets must initiate Regulators must impose standards for FIs to Regulators and bank leadership must develop conversations with FIs that issue “CoCo” bonds streamline their methodologies behind trigger the business processes required to act on real- to develop standardized attributes that can be calculations, and the frequency that results will time trigger notifications to determine if loan used by investors to make data-driven be entered into the tokenized “CoCo” bond absorption should be activated at that FI and investment decisions instruments across the market Why? Why? Why? Data fields and templates must be Investor confidence in “CoCo” bonds can only Since the viability of “CoCo” bonds is in standardized to tokenize “CoCo” bonds across increase if standardization exists within the question due to loan absorption, transparency FIs within the distributed ledger calculation process and, subsequently, loan is required in order for investors to continue absorption investments Challenge Challenge Challenge Each market requires different data to be Each FI currently calculates trigger values Regulators may require a significant process provided when issuing “CoCo” bonds; data field independently and with varying degrees of overhaul since they are traditionally restricted units are currently not standardized across FIs automation to point-in-time stress tests to analyse an FI’s capital ratio Critical condition categories WORLD ECONOMIC FORUM | 2016 Stakeholder Technology Regulatory Governance 90 alignment

The Future of Financial Infrastructure Page 89 Page 91

The Future of Financial Infrastructure Page 89 Page 91