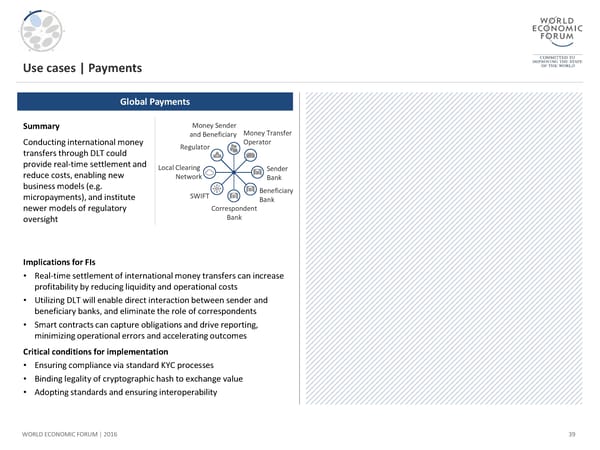

Use cases | Payments Global Payments Summary Money Sender and Beneficiary Money Transfer Conducting international money Regulator Operator transfers through DLT could provide real-time settlement and Local Clearing Sender reduce costs, enabling new Network Bank business models (e.g. Beneficiary micropayments), and institute SWIFT Bank newer models of regulatory Correspondent oversight Bank Implications for FIs • Real-time settlement of international money transfers can increase profitability by reducing liquidity and operational costs • Utilizing DLT will enable direct interaction between sender and beneficiary banks, and eliminate the role of correspondents • Smart contracts can capture obligations and drive reporting, minimizing operational errors and accelerating outcomes Critical conditions for implementation • Ensuring compliance via standard KYC processes • Binding legality of cryptographic hash to exchange value • Adopting standards and ensuring interoperability WORLD ECONOMIC FORUM | 2016 39

The Future of Financial Infrastructure Page 38 Page 40

The Future of Financial Infrastructure Page 38 Page 40