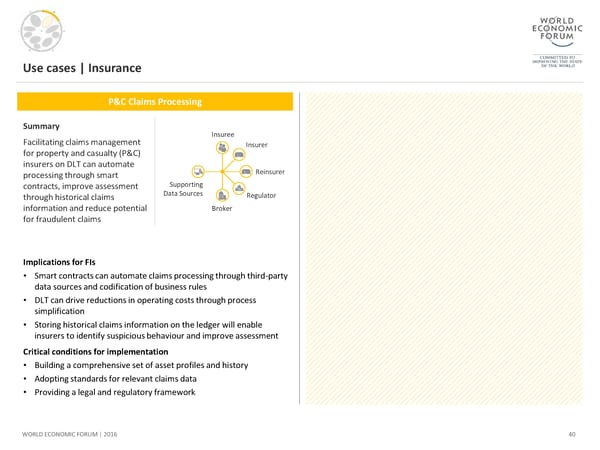

Use cases | Insurance P&C Claims Processing Summary Facilitating claims management Insuree for property and casualty (P&C) Insurer insurers on DLT can automate Reinsurer processing through smart contracts, improve assessment Supporting through historical claims Data Sources Regulator information and reduce potential Broker for fraudulent claims Implications for FIs • Smart contracts can automate claims processing through third-party data sources and codification of business rules • DLT can drive reductions in operating costs through process simplification • Storing historical claims information on the ledger will enable insurers to identify suspicious behaviour and improve assessment Critical conditions for implementation • Building a comprehensive set of asset profiles and history • Adopting standards for relevant claims data • Providing a legal and regulatory framework WORLD ECONOMIC FORUM | 2016 40

The Future of Financial Infrastructure Page 39 Page 41

The Future of Financial Infrastructure Page 39 Page 41