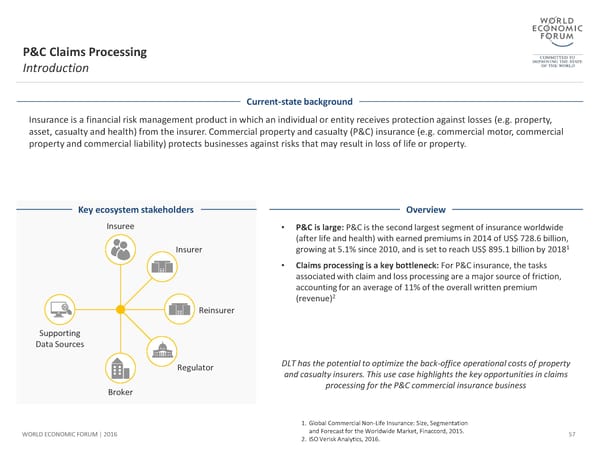

P&C Claims Processing Introduction Current-state background Insurance is a financial risk management product in which an individual or entity receives protection against losses (e.g. property, asset, casualty and health) from the insurer. Commercial property and casualty (P&C) insurance (e.g. commercial motor, commercial property and commercial liability) protects businesses against risks that may result in loss of life or property. Key ecosystem stakeholders Overview Insuree • P&C is large: P&C is the second largest segment of insurance worldwide (after life and health) with earned premiums in 2014 of US$ 728.6 billion, Insurer growing at 5.1% since 2010, and is set to reach US$ 895.1 billion by 20181 • Claims processing is a key bottleneck: For P&C insurance, the tasks associated with claim and loss processing are a major source of friction, accounting for an average of 11% of the overall written premium (revenue)2 Reinsurer Supporting Data Sources Regulator DLT has the potential to optimize the back-office operational costs of property and casualty insurers. This use case highlights the key opportunities in claims Broker processing for the P&C commercial insurance business 1. Global Commercial Non-Life Insurance: Size, Segmentation WORLD ECONOMIC FORUM | 2016 and Forecast for the Worldwide Market, Finaccord, 2015. 57 2. ISO Verisk Analytics, 2016.

The Future of Financial Infrastructure Page 56 Page 58

The Future of Financial Infrastructure Page 56 Page 58