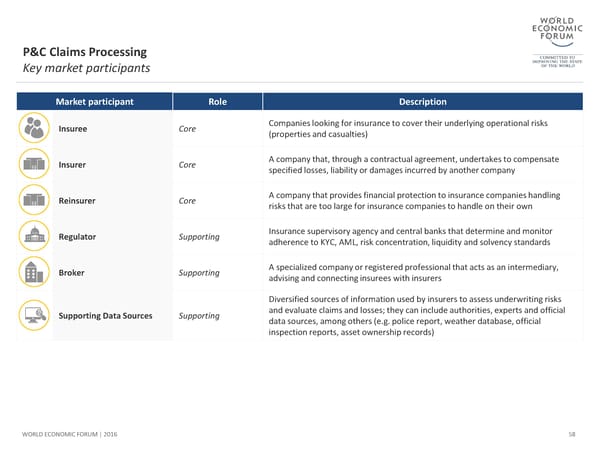

P&C Claims Processing Key market participants Market participant Role Description Insuree Core Companies looking for insurance to cover their underlying operational risks (properties and casualties) Insurer Core A company that, through a contractual agreement, undertakes to compensate specified losses, liability or damages incurred by another company Reinsurer Core A company that provides financial protection to insurance companies handling risks that are too large for insurance companies to handle on their own Regulator Supporting Insurance supervisory agency and central banks that determine and monitor adherence to KYC, AML, risk concentration, liquidity and solvency standards Broker Supporting A specialized company or registered professional that acts as an intermediary, advising and connecting insurees with insurers Diversified sources of information used by insurers to assess underwriting risks Supporting Data Sources Supporting and evaluate claims and losses; they can include authorities, experts and official data sources, among others (e.g. police report, weather database, official inspection reports, asset ownership records) WORLD ECONOMIC FORUM | 2016 58

The Future of Financial Infrastructure Page 57 Page 59

The Future of Financial Infrastructure Page 57 Page 59