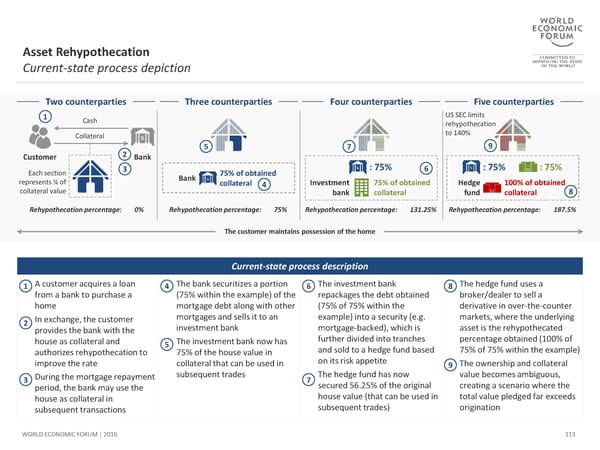

Asset Rehypothecation Current-state process depiction Two counterparties Three counterparties Four counterparties Five counterparties 1 Cash US SEC limits rehypothecation Collateral to 140% 5 7 9 Customer 2 Bank Each section 3 75% of obtained : 75% 6 : 75% : 75% represents ¼ of Bank collateral 4 Investment 75% of obtained Hedge 100% of obtained collateral value bank collateral fund collateral 8 Rehypothecation percentage: 0% Rehypothecation percentage: 75% Rehypothecation percentage: 131.25% Rehypothecation percentage: 187.5% The customer maintains possession of the home Current-state process description 1 A customer acquires a loan 4 The bank securitizes a portion 6 The investment bank 8 The hedge fund uses a from a bank to purchase a (75% within the example) of the repackages the debt obtained broker/dealer to sell a home mortgagedebt along with other (75% of 75% within the derivative in over-the-counter 2 In exchange, the customer mortgages and sells it to an example) into a security (e.g. markets, where the underlying provides the bank with the investment bank mortgage-backed), which is asset is the rehypothecated house as collateral and 5 The investment bank now has further divided into tranches percentage obtained (100% of authorizes rehypothecation to 75% of the house value in and sold to a hedge fund based 75% of 75% within the example) improve the rate collateral that can be used in on its risk appetite 9 The ownership and collateral 3 During the mortgage repayment subsequent trades 7 The hedge fund has now value becomes ambiguous, period, the bank may use the secured 56.25% of the original creating a scenario where the house as collateral in house value (that can be used in total value pledged far exceeds subsequent transactions subsequent trades) origination WORLD ECONOMIC FORUM | 2016 113

The Future of Financial Infrastructure Page 112 Page 114

The Future of Financial Infrastructure Page 112 Page 114