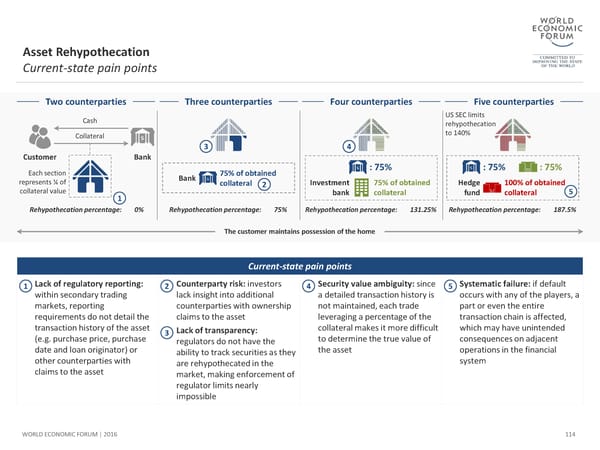

Asset Rehypothecation Current-state pain points Two counterparties Three counterparties Four counterparties Five counterparties Cash US SEC limits rehypothecation Collateral to 140% 3 4 Customer Bank Each section 75% of obtained : 75% : 75% : 75% represents ¼ of Bank collateral 2 Investment 75% of obtained Hedge 100% of obtained collateral value 1 bank collateral fund collateral 5 Rehypothecation percentage: 0% Rehypothecation percentage: 75% Rehypothecation percentage: 131.25% Rehypothecation percentage: 187.5% The customer maintains possession of the home Current-state pain points 1 Lack of regulatory reporting: 2 Counterparty risk: investors 4 Security value ambiguity: since 5 Systematic failure: if default within secondary trading lack insight into additional a detailed transaction history is occurs with any of the players, a markets, reporting counterparties with ownership not maintained, each trade part or even the entire requirements do not detail the claims to the asset leveraging a percentage of the transaction chain is affected, transaction history of the asset 3 Lack of transparency: collateral makes it more difficult which mayhave unintended (e.g. purchase price, purchase regulators do not have the to determine the true value of consequences on adjacent date and loan originator) or ability to track securities as they the asset operations in the financial other counterparties with are rehypothecated in the system claims to the asset market, making enforcement of regulator limits nearly impossible WORLD ECONOMIC FORUM | 2016 114

The Future of Financial Infrastructure Page 113 Page 115

The Future of Financial Infrastructure Page 113 Page 115