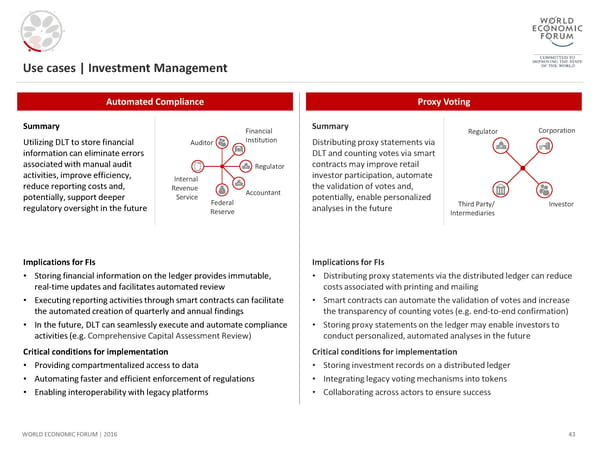

Use cases | Investment Management Automated Compliance Proxy Voting Summary Financial Summary Regulator Corporation Utilizing DLT to store financial Auditor Institution Distributing proxy statements via information can eliminate errors DLT and counting votes via smart associated with manual audit Regulator contracts may improve retail activities, improve efficiency, Internal investor participation, automate reduce reporting costs and, Revenue Accountant the validation of votes and, potentially, support deeper Service Federal potentially, enable personalized Third Party/ Investor regulatory oversight in the future Reserve analyses in the future Intermediaries Implications for FIs Implications for FIs • Storing financial information on the ledger provides immutable, • Distributing proxy statements via the distributed ledger can reduce real-time updates and facilitates automated review costs associated with printing and mailing • Executing reporting activities through smart contracts can facilitate • Smart contracts can automate the validation of votes and increase the automated creation of quarterly and annual findings the transparency of counting votes (e.g. end-to-end confirmation) • In the future, DLT can seamlessly execute and automate compliance • Storing proxy statements on the ledger may enable investors to activities (e.g. Comprehensive Capital Assessment Review) conduct personalized, automated analyses in the future Critical conditions for implementation Critical conditions for implementation • Providing compartmentalized access to data • Storing investment records on a distributed ledger • Automating faster and efficient enforcement of regulations • Integrating legacy voting mechanisms into tokens • Enabling interoperability with legacy platforms • Collaborating across actors to ensure success WORLD ECONOMIC FORUM | 2016 43

The Future of Financial Infrastructure Page 42 Page 44

The Future of Financial Infrastructure Page 42 Page 44