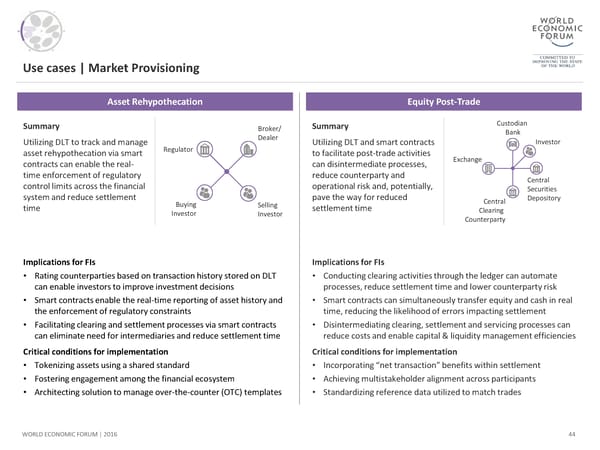

Use cases | Market Provisioning Asset Rehypothecation Equity Post-Trade Summary Broker/ Summary Custodian Dealer Bank Utilizing DLT to track and manage Utilizing DLT and smart contracts Investor asset rehypothecation via smart Regulator to facilitate post-trade activities contracts can enable the real- can disintermediate processes, Exchange time enforcement of regulatory reduce counterparty and Central control limits across the financial operational risk and, potentially, Securities system and reduce settlement Buying pave the way for reduced Central Depository time Selling settlement time Clearing Investor Investor Counterparty Implications for FIs Implications for FIs • Rating counterparties based on transaction history stored on DLT • Conducting clearing activities through the ledger can automate can enable investors to improve investment decisions processes, reduce settlement time and lower counterparty risk • Smart contracts enable the real-time reporting of asset history and • Smart contracts can simultaneously transfer equity and cash in real the enforcement of regulatory constraints time, reducing the likelihood of errors impacting settlement • Facilitating clearing and settlement processes via smart contracts • Disintermediating clearing, settlement and servicing processes can can eliminate need for intermediaries and reduce settlement time reduce costs and enable capital & liquidity management efficiencies Critical conditions for implementation Critical conditions for implementation • Tokenizing assets using a shared standard • Incorporating “net transaction” benefits within settlement • Fostering engagement among the financial ecosystem • Achieving multistakeholder alignment across participants • Architecting solution to manage over-the-counter (OTC) templates • Standardizing reference data utilized to match trades WORLD ECONOMIC FORUM | 2016 44

The Future of Financial Infrastructure Page 43 Page 45

The Future of Financial Infrastructure Page 43 Page 45