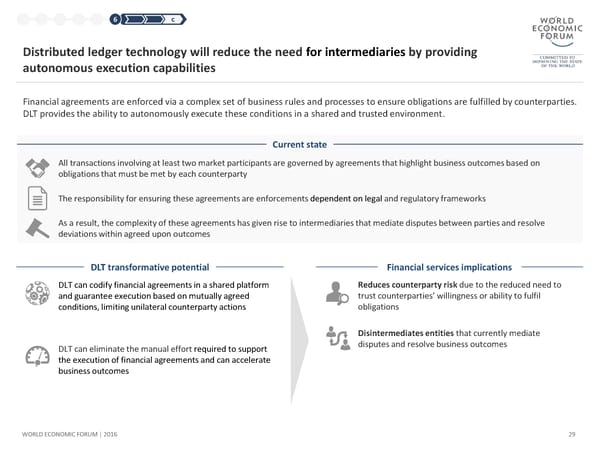

1 2 3 4 5 6 c Distributed ledger technology will reduce the need for intermediaries by providing autonomous execution capabilities Financial agreements are enforced via a complex set of business rules and processes to ensure obligations are fulfilled by counterparties. DLT provides the ability to autonomously execute these conditions in a shared and trusted environment. Current state All transactions involving at least two market participants are governed by agreements that highlight business outcomes based on obligations that must be met by each counterparty The responsibility for ensuring these agreements are enforcements dependent on legal and regulatory frameworks As a result, the complexity of these agreements has given rise to intermediaries that mediate disputes between parties and resolve deviations within agreed upon outcomes DLT transformative potential Financial services implications DLT can codify financial agreements in a shared platform Reduces counterparty risk due to the reduced need to and guarantee execution based on mutually agreed trust counterparties’ willingness or ability to fulfil conditions, limiting unilateral counterparty actions obligations Disintermediates entities that currently mediate DLT can eliminate the manual effort required to support disputes and resolve business outcomes the execution of financial agreements and can accelerate business outcomes WORLD ECONOMIC FORUM | 2016 29

The Future of Financial Infrastructure Page 28 Page 30

The Future of Financial Infrastructure Page 28 Page 30