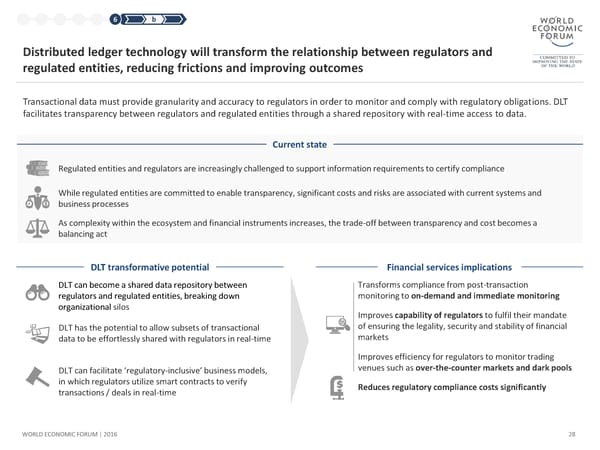

1 2 3 4 5 6 b Distributed ledger technology will transform the relationship between regulators and regulated entities, reducing frictions and improving outcomes Transactional data must provide granularity and accuracy to regulators in order to monitor and comply with regulatory obligations. DLT facilitates transparency between regulators and regulated entities through a shared repository with real-time access to data. Current state Regulated entities and regulators are increasingly challenged to support information requirements to certify compliance While regulated entities are committed to enable transparency, significant costs and risks are associated with current systems and business processes As complexity within the ecosystem and financial instruments increases, the trade-off between transparency and cost becomes a balancing act DLT transformative potential Financial services implications DLT can become a shared data repository between Transforms compliance from post-transaction regulators and regulated entities, breaking down monitoring to on-demand and immediate monitoring organizational silos Improves capability of regulators to fulfil their mandate DLT has the potential to allow subsets of transactional of ensuring the legality, security and stability of financial data to be effortlessly shared with regulators in real-time markets Improves efficiency for regulators to monitor trading DLT can facilitate ‘regulatory-inclusive’ business models, venues such as over-the-counter markets and dark pools in which regulators utilize smart contracts to verify Reduces regulatory compliance costs significantly transactions / deals in real-time WORLD ECONOMIC FORUM | 2016 28

The Future of Financial Infrastructure Page 27 Page 29

The Future of Financial Infrastructure Page 27 Page 29