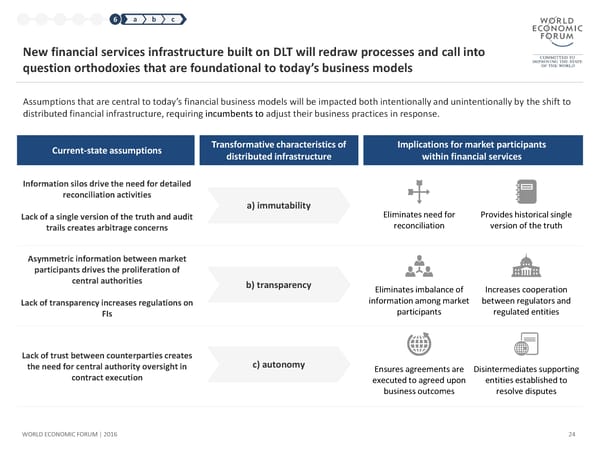

1 2 3 4 5 6 a b c New financial services infrastructure built on DLT will redraw processes and call into question orthodoxies that are foundational to today’s business models Assumptions that are central to today’s financial business models will be impacted both intentionally and unintentionally by the shift to distributed financial infrastructure, requiring incumbents to adjust their business practices in response. Current-state assumptions Transformative characteristics of Implications for market participants distributed infrastructure within financial services Informationsilos drive the need for detailed reconciliation activities a) immutability Eliminates need for Provides historical single Lack of a single version of the truth and audit reconciliation version of the truth trails creates arbitrage concerns Asymmetric information between market participants drives the proliferation of central authorities b) transparency Eliminates imbalance of Increases cooperation Lack of transparency increases regulations on information among market between regulators and FIs participants regulated entities Lack of trust between counterparties creates c) autonomy the need for central authority oversight in Ensures agreements are Disintermediates supporting contract execution executed to agreed upon entities established to business outcomes resolve disputes WORLD ECONOMIC FORUM | 2016 24

The Future of Financial Infrastructure Page 23 Page 25

The Future of Financial Infrastructure Page 23 Page 25