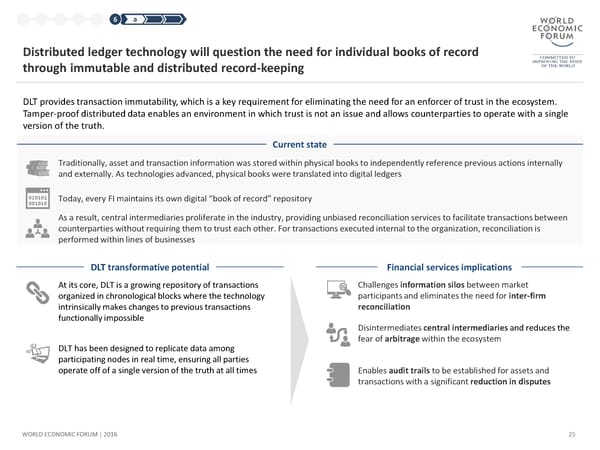

1 2 3 4 5 6 a Distributed ledger technology will question the need for individual books of record through immutable and distributed record-keeping DLT provides transaction immutability, which is a key requirement for eliminating the need for an enforcer of trust in the ecosystem. Tamper-proof distributed data enables an environment in which trust is not an issue and allows counterparties to operate with a single version of the truth. Current state Traditionally, asset and transaction information was stored within physical books to independently reference previous actions internally and externally. As technologies advanced, physical books were translated into digital ledgers Today, every FI maintains its own digital “book of record” repository As a result, central intermediaries proliferate in the industry, providing unbiased reconciliation services to facilitate transactions between counterparties without requiring them to trust each other. For transactions executed internal to the organization, reconciliation is performed within lines of businesses DLT transformative potential Financial services implications At its core, DLT is a growing repository of transactions Challenges information silos between market organized in chronological blocks where the technology participants and eliminates the need for inter-firm intrinsically makes changes to previous transactions reconciliation functionally impossible Disintermediates central intermediaries and reduces the fear of arbitrage within the ecosystem DLT has been designed to replicate data among participating nodes in real time, ensuring all parties operate off of a single version of the truth at all times Enables audit trails to be established for assets and transactions with a significant reduction in disputes WORLD ECONOMIC FORUM | 2016 25

The Future of Financial Infrastructure Page 24 Page 26

The Future of Financial Infrastructure Page 24 Page 26