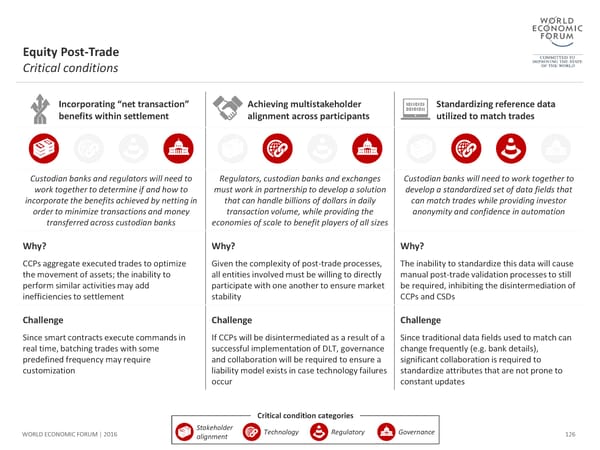

Equity Post-Trade Critical conditions Incorporating “net transaction” Achieving multistakeholder Standardizing reference data benefits within settlement alignment across participants utilized to match trades Custodian banks and regulators will need to Regulators, custodian banks and exchanges Custodian banks will need to work together to work together to determine if and how to must work in partnership to develop a solution develop a standardized set of data fields that incorporate the benefits achieved by netting in that can handle billions of dollars in daily can match trades while providing investor order to minimize transactions and money transaction volume, while providing the anonymity and confidence in automation transferred across custodian banks economies of scale to benefit players of all sizes Why? Why? Why? CCPs aggregate executed trades to optimize Given the complexity of post-trade processes, The inability to standardize this data will cause the movement of assets; the inability to all entities involved must be willing to directly manual post-trade validation processes to still perform similar activities may add participate with one another to ensure market be required, inhibiting the disintermediation of inefficiencies to settlement stability CCPs and CSDs Challenge Challenge Challenge Since smart contracts execute commands in If CCPs will be disintermediated as a result of a Since traditional data fields used to match can real time, batching trades with some successful implementation of DLT, governance change frequently (e.g. bank details), predefined frequency may require and collaboration will be required to ensure a significant collaboration is required to customization liability model exists in case technology failures standardize attributes that are not prone to occur constant updates Critical condition categories WORLD ECONOMIC FORUM | 2016 Stakeholder Technology Regulatory Governance 126 alignment

The Future of Financial Infrastructure Page 125 Page 127

The Future of Financial Infrastructure Page 125 Page 127