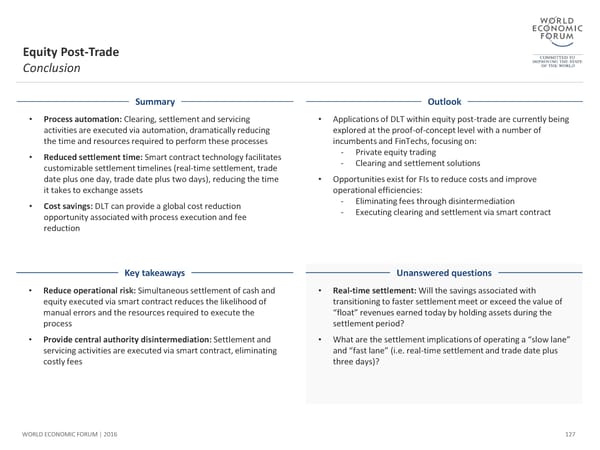

Equity Post-Trade Conclusion Summary Outlook • Process automation: Clearing, settlement and servicing • Applications of DLT within equity post-trade are currently being activities are executed via automation, dramatically reducing explored at the proof-of-concept level with a number of the time and resources required to perform these processes incumbents and FinTechs, focusing on: • Reduced settlement time: Smart contract technology facilitates - Private equity trading customizable settlement timelines (real-time settlement, trade - Clearing and settlement solutions date plus one day, trade date plus two days), reducing the time • Opportunities exist for FIs to reduce costs and improve it takes to exchange assets operational efficiencies: • Cost savings: DLT can provide a globalcost reduction - Eliminating fees through disintermediation opportunityassociated with process execution and fee - Executing clearing and settlement via smart contract reduction Key takeaways Unanswered questions • Reduce operational risk:Simultaneous settlement of cash and • Real-time settlement: Will the savings associated with equity executed via smart contract reduces the likelihood of transitioning to faster settlement meet or exceed the value of manual errors and the resources required to execute the “float” revenues earned today by holding assets during the process settlement period? • Provide central authority disintermediation: Settlement and • What are the settlement implications of operating a “slow lane” servicing activities are executed via smart contract, eliminating and “fast lane” (i.e. real-time settlement and trade date plus costly fees three days)? WORLD ECONOMIC FORUM | 2016 127

The Future of Financial Infrastructure Page 126 Page 128

The Future of Financial Infrastructure Page 126 Page 128