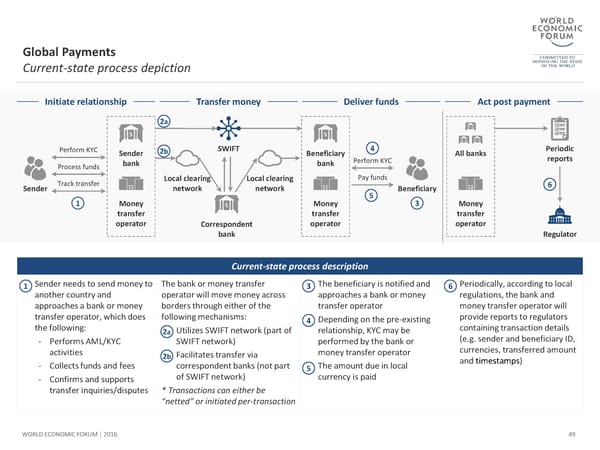

Global Payments Current-state process depiction Initiate relationship Transfer money Deliver funds Actpost payment 2a Perform KYC Sender 2b SWIFT Beneficiary 4 All banks Periodic bank bank Perform KYC reports Process funds Track transfer Local clearing Local clearing Pay funds 6 Sender network network 5 Beneficiary 1 Money Money 3 Money transfer transfer transfer operator Correspondent operator operator bank Regulator Current-state process description 1 Senderneeds to send money to Thebank or money transfer 3 The beneficiary is notified and 6 Periodically, according to local another country and operator will move money across approaches a bank or money regulations, the bank and approaches a bank or money borders through either of the transfer operator money transfer operator will transfer operator, which does following mechanisms: 4 Depending on the pre-existing provide reports to regulators the following: - Utilizes SWIFT network (part of relationship, KYC may be containing transaction details 2a (e.g. sender and beneficiary ID, - Performs AML/KYC SWIFT network) performed by the bank or currencies, transferred amount activities - Facilitates transfer via money transfer operator 2b and timestamps) - Collects funds and fees correspondent banks (not part 5 The amount due in local - Confirms and supports of SWIFT network) currency is paid transfer inquiries/disputes * Transactions can either be “netted” or initiated per-transaction WORLD ECONOMIC FORUM | 2016 49

The Future of Financial Infrastructure Page 48 Page 50

The Future of Financial Infrastructure Page 48 Page 50